Question: The following is the cost data per unit for KopyKat Companys single product, the Kat: Prime cost ................................................. $ 13 Variable manufacturing overhead .............. 5

The following is the cost data per unit for KopyKat Company€™s single product, the €œKat€:

Prime cost ................................................. $ 13

Variable manufacturing overhead .............. 5

Variable selling and administrative ............ 3

Fixed costs per month

Manufacturing ........................................... $300,000

Selling and administrative ......................... 260,000

Total fixed cost .......................................... $560,000

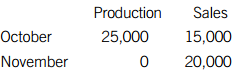

The selling price per unit is $50. The production and sales data for October and November are as follows:

There were 10,000 units in finished goods inventory on October 1, with a value of $280,000. Total fixed costs have remained the same in September, October, and November. Similarly, the variable cost per unit has remained the same in September, October, and November. The company uses the FIFO inventory cost flow assumption.

Required:

A. Prepare an absorption costing income statement for October and November.

B. Adjust the absorption costing income to obtain the variable costing income. Do not prepare the variable costing income statements.

C. The CEO of KopyKat, who is provided with only the absorption costing income statement, is not pleased with the financial performance in November. €œI thought we would do better in November since we were able to meet our sales target, which is higher than in the previous month. This does not make sense to me!€ Indicate in which month the company performed better, in your opinion. Explain briefly to the CEO.

Sales Production October 25,000 15,000 November 20,000

Step by Step Solution

3.36 Rating (168 Votes )

There are 3 Steps involved in it

A The following calculations will be used in the solution i Units in beginning and ending inventory October November Beginning inventory 10000 units 20000 units Production 25000 Good available for sal... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (2 attachments)

1601_606321ef074d3_688785.pdf

180 KBs PDF File

1601_606321ef074d3_688785.docx

120 KBs Word File