This year, Paintbrush, Inc., manufactured 55,000 units of part YS15, and it sold 50,000 units at $60

Question:

Required:

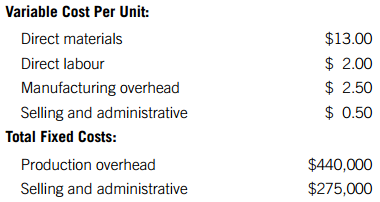

A. Prepare income statements using absorption costing, variable costing, and throughput costing. Provide the details of your calculations in a schedule for each income statement.

B. Reconcile the difference between operating incomes based on absorption costing and variable costing. Create a schedule to show your work.

C. Reconcile the difference between operating incomes based on variable costing and throughput costing. Create a schedule to show your work.

D. Suppose the accountant for Paintbrush, Inc. used an actual fixed overhead allocation rate rather than an estimated rate. Using this method, calculate the cost of goods sold and ending inventory under absorption costing. Compare the results to those calculated in Part A.

E. If the volume variance is not material, how is it closed at the end of the period? Explain the reasoning behind this treatment.

Ending InventoryThe ending inventory is the amount of inventory that a business is required to present on its balance sheet. It can be calculated using the ending inventory formula Ending Inventory Formula =...

Step by Step Answer:

Cost Management Measuring, Monitoring and Motivating Performance

ISBN: 978-1119185697

3rd Canadian edition

Authors: Leslie G. Eldenburg, Susan K. Wolcott, Liang Hsuan Chen, Gail Cook