A trader shorts one share of a stock index for 50 and buys a 60-strike European call

Question:

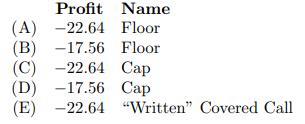

A trader shorts one share of a stock index for 50 and buys a 60-strike European call option on that stock that expires in 2 years for 10. Assume the annual effective risk-free interest rate is 3%. The stock index increases to 75 after 2 years. Calculate the profit on your combined position, and determine an alternative name for this combined position.

Transcribed Image Text:

Profit Name (A) 22.64 Floor 17.56 Floor (B) (C) (D) (E) -22.64 "Written" Covered Call 22.64 Cap 17.56 Cap

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (QA)

B A position consisting of a short asset position a...View the full answer

Answered By

Elias Gichuru

am devoted to my work and dedicated in helping my clients accomplish their goals and objectives,providing the best for all tasks assigned to me as a freelancer,providing high quality work that yields high scores.promise to serve them earnestly and help them achieve their goals.i have the needed expertise,knowledge and experience to handle their tasks.

4.80+

325+ Reviews

859+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

Last Sale Net Bid Ask Open Int Puts Last Sale Net bid Ask Vol Open Int 16Aug 155.00(1619H155-E) 6.45 0.75 6.95 7.25 9 16Aug 155.00(1619T155-E) 1.18 (0.75) 1.17 1.25 61 4505 16Aug 166.00(1619H160-E)...

-

26. With its current leverage, Impi Corporation will have net income next year of 4.5 million. If Impis corporate tax rate is 35% and pay 8% interest on its debt, how much additional debt can Impi...

-

To insure a stock portfolio against price decreases, owners of stock portfolios should a on the stock index? A call option with a strike price of Rs55 can be bought for Rs4. What will be your net...

-

We are given a number of darts. Suppose it is known that each time we throw a dart at a target, we have a probability of 1/4 of hitting the target. An experiment consists of throwing three darts at...

-

The following information is available for the Butler Company, which began operations in 2007: Required 1. Prepare the journal entries for 2007 and 2008. 2. Prepare a partial income statement and a...

-

Professional athletes regularly sign long-term multimillion-dollar contracts in which they promise to play for a particular team for a specified time period. Owners of these teams often sign...

-

The Korvette concept was started and run by one person and his group of friends. How could its failure have been avoided? Was the problem one of strategy (overexpansion), or was it organizational?...

-

Nature's Best Publishing Company pays its employees monthly. Payments made by the company on October 31, 2016, follow. Cumulative amounts paid to the persons named prior to October 31 are also given....

-

A wheel initially at rest begins rotating because of a constant angular acceleration. During a certain interval AT = 13s, the wheel goes through 84 rev and reaches an angular speed of 11 rev/s. (a)...

-

You are selecting among various put options with different strike prices to hedge a long asset position. Which of the following statements is true? Give your reasoning. (A) Higher-strike puts cost...

-

You are given: (i) The current price of a stock is 70. (ii) The continuously compounded risk-free interest rate is 5%. (iii) The price of a 70-strike 1-year European call option is 5. (iv) The price...

-

ReduX Corporation is planning to change their management program. The company needs to choose on one out of four different management programs provided by four different programming companies. Before...

-

A crane lifts a 1100kg car vertically with a constant acceleration of 0.75 ms^-2. The car is raised through a height of 4m during this acceleration. a) Determine the value of the force needed to lift...

-

1. Consider the two vectors A = 2 - 3 and B = - + 2. Calculate: A) A+ B B) A-B C) The magnitude of A+ B D) The magnitude of A B E) The angle of off the x-axis for + B F) The angle of off the x-axis...

-

6. Using Euler's Formula, show that y = Cei(wt+d) + Cei(wt+p) is equivalent to y = A cos (wt + p) for a judicious choice of C, C and A. In fact, derive a single mathematical relationship between C,...

-

The table presents the mass percentages for various body segments. The moments of inertia for the foot, leg (shank) and thigh, and the distances between their respective centers of mass and the hip...

-

It takes about 20 kJ to melt an ice cube. If a microwave is rated at 1200 W, then how much time would it take for it to melt the cube?

-

If you were Gov. Blagojevichs public relations advisor, how would you have suggested he respond to the seating of Roland Burris as senator?

-

In muscle tissue, the ratio of phosphorylase a to phosphorylase b determines the rate of conversion of glycogen to glucose 1phosphate. Classify how each event affects the rate of glycogen breakdown...

-

A depreciable asset costs $10,000 and has an estimated salvage value of $1600 at the end of its 6-year depreciable life. Compute the depreciation schedule for this asset by both SOYD depreciation and...

-

A million-dollar oil drilling rig has a 6-year depreciable life and a $75,000 salvage value at the end of that time. Determine which one of the following methods provides the preferred depreciation...

-

A new machine tool is being purchased for $16,000 and is expected to have a zero salvage value at the end of its 5-year useful life. Compute the DDB depreciation schedule for this capital asset....

-

A comparative balance sheet for Carla Corporation is presented as follows. Prepare a statement of cash flows for 2025 for Carla Corporation. (Show amounts that decrease cash flow with either a-sign...

-

On 12-31-20, Austin entered into an agreement that required Austin to pay a supplier $900 every year on 12-31 until 12- 31-27. Assume the market rate of interest for Austin is 4%. Assume the...

-

As the Sales Manager, Akhyar has been given a profit target of RM635,000 for the second half of 2023. The relevant data for the first half of 2023 are as follows: Sales revenue Variable costs Fixed...

Study smarter with the SolutionInn App