Assume the Black-Scholes framework. One year ago, Kelvin bought 1,000 units of a European call option on

Question:

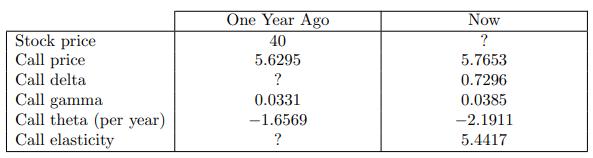

Assume the Black-Scholes framework. One year ago, Kelvin bought 1,000 units of a European call option on a nondividend-paying stock. He immediately delta-hedged his position with appropriate number of shares of the stock, but has not ever re-balanced his portfolio. He now decides to close out all positions.

You are given:

(i) The stock’s volatility is 20%.

(ii)

Calculate Kelvin’s 1-year holding profit.

Transcribed Image Text:

Stock price Call price Call delta Call gamma Call theta (per year) Call elasticity One Year Ago 40 5.6295 ? 0.0331 -1.6569 ? Now ? 5.7653 0.7296 0.0385 -2.1911 5.4417

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (QA)

From the current elasticity we have S1 Ac1 C1 S1 43 Further...View the full answer

Answered By

Utsab mitra

I have the expertise to deliver these subjects to college and higher-level students. The services would involve only solving assignments, homework help, and others.

I have experience in delivering these subjects for the last 6 years on a freelancing basis in different companies around the globe. I am CMA certified and CGMA UK. I have professional experience of 18 years in the industry involved in the manufacturing company and IT implementation experience of over 12 years.

I have delivered this help to students effortlessly, which is essential to give the students a good grade in their studies.

3.50+

2+ Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

Assume the Black-Scholes framework. Four months ago, Eric bought 100 units of a one-year 45-strike European call option on a nondividend-paying stock. He immediately delta-hedged his position with...

-

One year ago, Jacky bought 10 units of a 2-year at-the-money European straddle on a nondividend-paying stock. He immediately delta-hedged his position with shares of the stock, but has not ever...

-

Assume the Black-Scholes framework. Three months ago, Tyler bought 100 units of an at-the-money European call option on a nondividend-paying stock. He immediately delta-hedged his position with...

-

A stock has a beta of 1.55 and an expected return of 15 percent. A risk-free asset currently earns 2.2 percent. a. What is the expected return on a portfolio that is equally invested in the two...

-

The Goodman Company acquired a truck from the Harmes Company in exchange for a machine. The machine cost $30,000, has a book value of $6,000, and has a market value of $9,000. The truck has a cost of...

-

a. An analysis of WTI s insurance policies shows that $2,400 of coverage has expired. b. An inventory count shows that teaching supplies costing $2,800 are available at year-end. c. Annual...

-

Refer to the information in Exercise 16-6. Assume that Fields uses the FIFO method of process costing. 1. Calculate the equivalent units of production for the forming department. 2. Calculate the...

-

Ravsten Company uses a job-order costing system. On January 1, the beginning of the current year, the companys inventory balances were as follows: Raw materials . . . . . . . . . $16,000 Work in...

-

Defining the database management system and identifying the differences between a database and a database management system (DBMS) or relational database management system (RDBMS). Please provide the...

-

Assume the Black-Scholes framework. Three months ago, you sold 1,000 units of a 1-year European put option on a nondividend-paying stock. You immediately delta-hedged your position with appropriate...

-

Assume the Black-Scholes framework. Determine all value(s) of a, in terms of r, , , such that V (S(t), t) := AS(t) a e t represents the time-t price of a derivative security on a nondividend-paying...

-

A biologist collected data on the height (in inches) and peak expiratory flow (PEF-a measure of how much air a person can expire, measured in l/min) for 10 women. Here are the data: Is PEF related to...

-

A uniform ladder has length L = 9.0 m and weighs 250 N. The ladder rests against a smooth vertical wall, as shown in the figure. The angle between the ladder and the rough floor is 0 = 50 degrees....

-

*(f) The infrared spectrum of this unknown shows a strong peak near 1715 cm. Relative Abundance 100 80- 60 40- 20- 43 72 L 20 25 30 35 40 45 50 55 60 65 70 75 80 85 90 95 100 105 110 115 120 125 130...

-

Can you help me solve this using this data and make the path length =0.05 Part II. Ferrichrome A. Your TA will give you a solution of unknown concentration of ferrichrome A. From its millimolar...

-

Subang to thogong boyredo ne TO el gubwollo) sa zoban visart 5. The analysis of a rocket fuel showed that it contained 87.4% nitrogen and 12.6% hydrogen by weight. The fuel's molar mass was...

-

How many 13167= Gm3 are in 2.58 x 109 mL. ballpark: 3x10-14 Gm ZONE DEOJUE

-

List the five stages of the industry life cycle. How does the pattern of cash dividend payments change over the cycle? (A general statement is all that is required.)

-

Marc Company assembles products from a group of interconnecting parts. The company produces some of the parts and buys some from outside vendors. The vendor for Part X has just increased its price by...

-

AI Dale is planning his Christmas shopping for seven people. To quantify how much his various relatives would enjoy receiving items from a list of prospective gifts AI has assigned appropriateness...

-

The following facts are to be used in solving Problems 17-4 through 17.7 in assembling data for the Peabody Company annual capital budget five independent projects are being considered. Detailed...

-

For an unlimited supply of money, and replacement Assumption 1, which project alternatives should Peabody select? Solve the problem by present worth methods. (Answer: Alternatives 1B, 2A, 3F, 4A, and...

-

Desperate Housewives Tom and Lynette Scavo are thinking of purchasing a new minivan for their family. The minivan is loaded with options and will cost $40,000 with an expected useful life of eight...

-

If there are 70,000,000 shares outstanding, what is the impact on the market value of the firm? Projections for a firm whose stock you wish to value: Years 1 - 7 Years 8 - 11 Years 12 - 24 EPS 2.35...

-

Calculate the expected returns for Roll and Ross by filling in the following table (verify your answer by expressing returns as percentages as well as decimals): (Negative amounts should be indicated...

Study smarter with the SolutionInn App