Assume the Black-Scholes framework. Two actuaries, A and B, are computing the prices of a European call

Question:

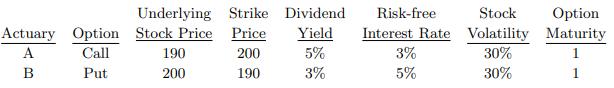

Assume the Black-Scholes framework. Two actuaries, A and B, are computing the prices of a European call and a European put using different parameters.

You are given:

Describe the relationship between the call price computed by Actuary A and the put price computed by Actuary B.

Transcribed Image Text:

Actuary A B Option Call Put Underlying Strike Dividend Stock Price Price Yield 5% 3% 190 200 200 190 Risk-free Stock Interest Rate Volatility 30% 30% 3% 5% Option Maturity 1

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (1 review)

The call price computed by Actuary A turns out to be identical to the put pri...View the full answer

Answered By

Muhammad Umair

I have done job as Embedded System Engineer for just four months but after it i have decided to open my own lab and to work on projects that i can launch my own product in market. I work on different softwares like Proteus, Mikroc to program Embedded Systems. My basic work is on Embedded Systems. I have skills in Autocad, Proteus, C++, C programming and i love to share these skills to other to enhance my knowledge too.

3.50+

1+ Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

Two actuaries, A and B, use a two-period binomial forward tree to compute the prices of a European call and a European put using different parameters. You are given: Describe the relationship between...

-

In this problem, you will use your knowledge of the phase plane and stability to analyze a simple model of glycolysis. The glycolysis pathway that first convert glucose into fructose-6-phosphate...

-

The Woodson Theater sells season theater tickets for $200 each. Each ticket entitles the customer to attend 5 plays. The first play will be in December. On December 1, 20X1, 400 season tickets were...

-

Consider the example in Exhibit 5.5. Can you think of anything else you might do with that example that would be helpful to the ultimate decisionmaker? exhibit 5.5 Decision Tree Analysis Using Net...

-

The following petty cash transactions of Grayson Gaming Supplies occurred in March: Established a petty cash fund with a $150 balance. The petty cash fund has $14 in cash and $148 in petty cash...

-

New-Rage Cosmetics uses a traditional cost accounting system to allocate quality control costs uniformly to all products at a rate of 14.5% of direct labor cost. Monthly direct labor cost for Satin...

-

The Cooper Furniture Company of Potomac, Maryland, assembles two types of chairs (Recliners and Rockers). Separate assembly lines are used for each type of chair. Classify each cost item (AI) as...

-

The beginning inventory at RTE Office Supplies and data on purchases and sales for a three-month period are shown in Problem 6-1A. Instructions 1. Record the inventory, purchases, and cost of...

-

(a) Let3+ and 2 = a + bi be complex numbers. Suppose that 7 Argument = 12' find Argument(22). 7-2 (b) Let the map f: CC be defined by f(z) = Find f() if=1+2i. 1 (c) Solve the equation -12 i(9-2),...

-

Consider two nondividend-paying stocks whose time-t prices are denoted by S 1 (t) and S 2 (t), respectively. You are given: (i) S 1 (0) = S 2 (0) = 10. (ii) Stock 1s volatility is 25%. (iii) Stock 2s...

-

Assume the Black-Scholes framework. For a 5-month European gap put option on a nondividend-paying stock, you are given: (i) The current price of the stock is 120. (ii) The stocks volatility is 20%....

-

Sketch the vector field F by drawing a diagram like Figure 5 or Figure 9. F(x, y) = y i - x j/x 2 + y 2

-

What is the runtime complexity (T(N), the number of operations performed) of the following algorithm for an input of size N? i = n - 1; sum = 0; while (i>=0) { } sum = sum + a[i]; 1--;

-

In late-March and April, the prices for hand sanitizer dramatically increased. For example, on Amazon, a 2-ounce bottle of Purell was listed at $40; the pre-COVID price was about $2. Amazon delisted...

-

How do ethical leaders navigate complex ethical dilemmas, considering the interests of multiple stakeholders while upholding principles of integrity and social responsibility?

-

How does a company calculate its net income?

-

You MUST answer the entirety of this question a. The appeal of the "free market model" (perfect competition) is that it maximizes efficiency in production and maximizes consumer welfare if all of the...

-

What types of organizations use flexible budgets?

-

Q:1 Take any product or service offered in Pakistan and apply all determinents of customer Perceived value ?

-

The balance sheets of Hutter Amalgamated are shown below. If the 12/31/2004 value of operations is $756 million, what is the 12/31/2004 value of equity? Balance Sheets, December 31, 2004 (Millions of...

-

The balance sheets of Roop Industries are shown below. The 12/31/2004 value of operations is $651 million and there are 10 million shares of common equity. What is the price per share? Balance...

-

The financial statements of Lioi Steel Fabricators are shown below, with the actual results for 2004 and the projections for 2005. Free cash flow is expected to grow at a 6 percent rate after 2005....

-

Oriole Inc. owes Buffalo Bank $168,000 plus $17,200 of accrued interest. The debt is a 10-year, 10% note. During 2023, Oriole's business declined due to a slowing regional economy. On December 31,...

-

For each of the following independent cases (A to E), compute the missing values in the table: Case Prime Cost Conversion Cost Direct Materials Direct Manufacturing Total Manufacturing Labor Overhead...

-

The following information is available for two different types of businesses for the Year 1 accounting year. Hopkins CPAs is a service business that provides accounting services to small businesses....

Study smarter with the SolutionInn App