Question: Assume the Black-Scholes framework. You are given: (i) The current price of a nondividend-paying stock is 70. (ii) The stocks volatility is 25%. (iii) The

Assume the Black-Scholes framework. You are given:

(i) The current price of a nondividend-paying stock is 70.

(ii) The stock’s volatility is 25%.

(iii) The continuously compounded risk-free interest rate is 5%.

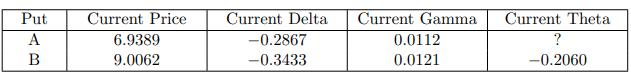

(iv) The following information about two European put options on the stock:

Suppose you have just sold 1,000 units of Put A. You immediately delta-hedge and thetahedge your position by trading appropriate units of Put B and the stock. Calculate the amount of net investment you make today (including the sale of the 1,000 Put A).

Put A B Current Price 6.9389 9.0062 Current Delta -0.2867 -0.3433 Current Gamma 0.0112 0.0121 Current Theta ? -0.2060

Step by Step Solution

3.38 Rating (164 Votes )

There are 3 Steps involved in it

We need the current delta of Put A By the BlackScholes equation 005 ... View full answer

Get step-by-step solutions from verified subject matter experts