Question: Assume the Black-Scholes framework. You are given: (i) The current price of a nondividend-paying stock is 50. (ii) The stocks volatility is 30%. (iii) The

Assume the Black-Scholes framework. You are given:

(i) The current price of a nondividend-paying stock is 50.

(ii) The stock’s volatility is 30%.

(iii) The continuously compounded risk-free interest rate is 8%.

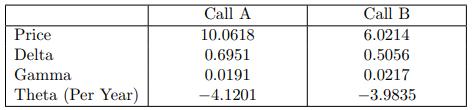

(iv) The following information about two European call options on the stock:

In each of the following cases, calculate the amount of the net investment you make today (including the sale of the 1,000 options in the first place):

(a) You have just sold 1,000 units of Call A. You immediately delta-hedge your position with shares of the stock.

(b) You have just sold 1,000 units of Call A. You immediately delta-hedge and gamma-hedge your position with shares of the stock and Call B.

(c) You are now further given that Call A is 50-strike and Call B is 60-strike, and both of them are 18-month call options. You have just sold 1,000 units of a 50-strike put otherwise identical to Call A. You immediately delta-hedge and theta-hedge your position with Call A and Call B.

Price Delta Gamma Theta (Per Year) Call A 10.0618 0.6951 0.0191 -4.1201 Call B 6.0214 0.5056 0.0217 -3.9835

Step by Step Solution

3.24 Rating (159 Votes )

There are 3 Steps involved in it

To calculate the net investment in each case we need to consider the cost or proceeds from the initi... View full answer

Get step-by-step solutions from verified subject matter experts