For a stock, you are given: (i) The current stock price is $50.00. (ii) = 0.08.

Question:

For a stock, you are given:

(i) The current stock price is $50.00.

(ii) δ = 0.08.

(iii) The continuously compounded risk-free interest rate is r = 0.04.

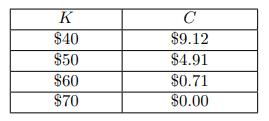

(iv) The prices for one-year European calls (C) under various strike prices (K) are shown below:

You own four special put options, each with one of the strike prices listed in (iv). Each of these put options can only be exercised immediately or one year from now.

Determine the lowest strike price for which it is optimal to exercise these special put option(s) immediately.

(A) $40

(B) $50

(C) $60

(D) $70

(E) It is not optimal to exercise any of these put options.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: