Question: You are given: C(K, T) denotes the current price of a K-strike T-year European call option on a nondividend-paying stock. P(K, T) denotes

You are given:

• C(K, T) denotes the current price of a K-strike T-year European call option on a nondividend-paying stock.

• P(K, T) denotes the current price of a K-strike T-year European put option on the same stock.

• S denotes the current price of the stock.

• The continuously compounded risk-free interest rate is r.

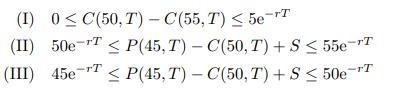

Which of the following is (are) correct?

(A) (I) only

(B) (II) only

(C) (III) only

(D) (I) and (II) only

(E) (I) and (III) only

(I) 0 C(50, T) - C(55, T) 5e-T (II) 50e-T

Step by Step Solution

3.36 Rating (149 Votes )

There are 3 Steps involved in it

E I is true Call price is a decreasing function of K so C50 ... View full answer

Get step-by-step solutions from verified subject matter experts