The current price for a stock index is 1,000. The following premiums exist for various options to

Question:

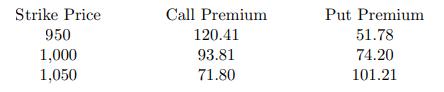

The current price for a stock index is 1,000. The following premiums exist for various options to buy or sell the stock index six months from now:

Strategy I is to buy the 1,050-strike call and to sell the 950-strike call.

Strategy II is to buy the 1,050-strike put and to sell the 950-strike put.

Strategy III is to buy the 950-strike call, sell the 1,000-strike call, sell the 950-strike put, and buy the 1,000-strike put.

Assume that the price of the stock index in 6 months will be between 950 and 1,050.

Determine which, if any, of the three strategies will have greater payoffs in six months for lower prices of the stock index than for relatively higher prices.

(A) None

(B) I and II only

(C) I and III only

(D) II and III only

(E) The correct answer is not given by (A), (B), (C), or (D)

Step by Step Answer: