You are given the following with respect to a public company: The common shares of the

Question:

You are given the following with respect to a public company:

• The common shares of the company were trading at 100 as of December 31, 2015.

• No dividends are paid.

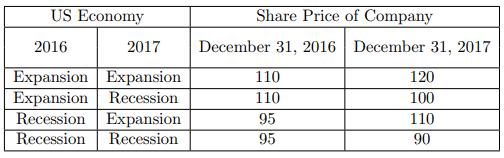

• An industry analyst has projected the possible stock prices over the next two years as a function of the performance of the US economy:

• The effective annual risk-free interest rate that prevails in Year 2016 (i.e., from January 1, 2016 to December 31, 2016) is 5%.

• The effective annual risk-free interest rate that prevails in Year 2017 is 6% if 2016 has seen an expansion, and 4% if 2016 has seen a recession.

Using the analyst’s projections, determine the price, as of December 31, 2015, of a two-year European strangle constructed by buying a 100-strike European put option and a 110-strike European call option.

Step by Step Answer: