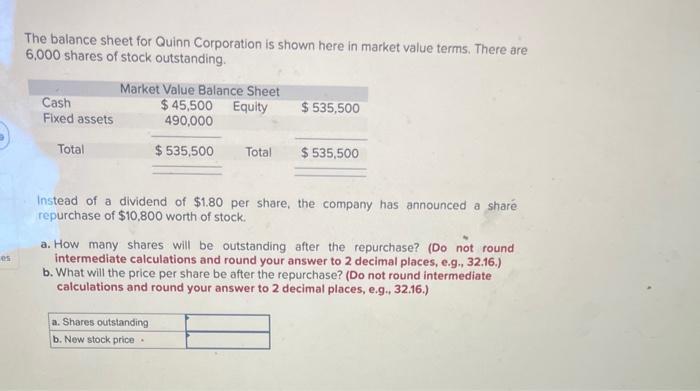

The balance sheet for Quinn Corporation is shown here in market value terms. There are 6,000...

Fantastic news! We've Found the answer you've been seeking!

Question:

Related Book For

Corporate Finance Core Principles and Applications

ISBN: 978-1259289903

5th edition

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe, Bradford Jordan

Posted Date: