You hold a trading book consisting of many long/short positions in Tempranillo Corp. stock and options. You

Question:

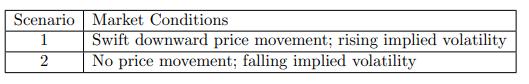

You hold a trading book consisting of many long/short positions in Tempranillo Corp. stock and options. You are analyzing two possible scenarios for Tempranillo Corp. stock and want to make money by adjusting your trading book.

(a) For each of the above scenarios, determine whether a positive or negative delta, gamma, or vega in your trading book would produce a profit.

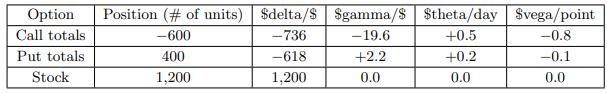

Now consider the table below which summarizes your positions at the prior day’s close of trading:

where $delta/$ is the change in the $ value of your portfolio per $1 change in the underlying asset or index.

Today Tempranillo Corp.’s stock price dropped $4 and implied volatility on all options rose 2 percentage points.

(b) Estimate the value change in your trading book at closing today.

Step by Step Answer: