In this chapter, we developed the following approaches to solving the option pricing problem: (a) The PDE

Question:

In this chapter, we developed the following approaches to solving the option pricing problem:

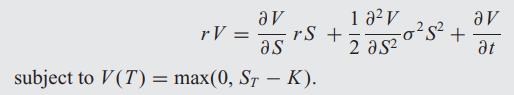

(a) The PDE approach: In this method, we found that the call option value was the solution to the following differential equation:

(b) The risk-neutral approach: In this method, we solved for the option price by taking the following expectation (under the risk-neutral measure):

![]()

The answer to both these methods was found to be the same. Is this always true?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: