Question: Use the data in Exercise 12-42 for Irv Nelson, Inc., and MACRS. The asset qualifies as a 5-year property. Required Compute for the investment its:

Use the data in Exercise 12-42 for Irv Nelson, Inc., and MACRS. The asset qualifies as a 5-year property.

Required

Compute for the investment its:

1. Payback period under the assumption that the cash inflows occur evenly throughout the year.

2. Book rate of return based on: (a) the initial investment, and (b) an average investment (calculated as a simple average of the 10 average annual book values).

3. Net present value (NPV).

4. Internal rate of return (IRR).

5. Modified internal rate of return(MIRR).

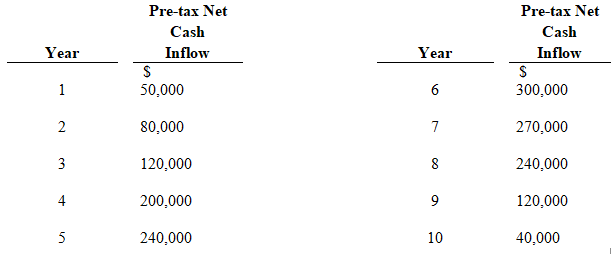

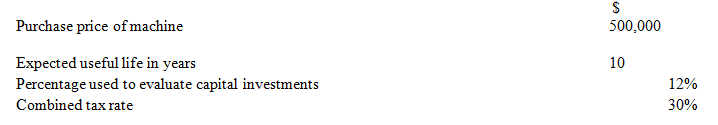

Pre-tax Net Pre-tax Net Cash Cash Year Inflow Year Inflow 50,000 300,000 80,000 270,000 3 120,000 240,000 200,000 4 120,000 5 240,000 10 40,000 2.

Step by Step Solution

3.49 Rating (162 Votes )

There are 3 Steps involved in it

1 Payback period Savings or Net Net Cumulative Net Expense Aftertax Aftertax Net Aftertax Cash Depreciation Taxable on Income Income Cash Cash Year In... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

249-B-M-L-P (571).xlsx

300 KBs Excel File