Question: In this problem we extend the Vasicek model to allow the mean rate to become stochastic. Think of a situation in which the Federal

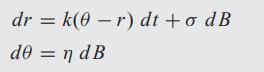

In this problem we extend the Vasicek model to allow the mean rate θ to become stochastic. Think of a situation in which the Federal Reserve makes minor adjustments to short-term market rates to manage the temperature of the economy. The model comprises the following two equations:

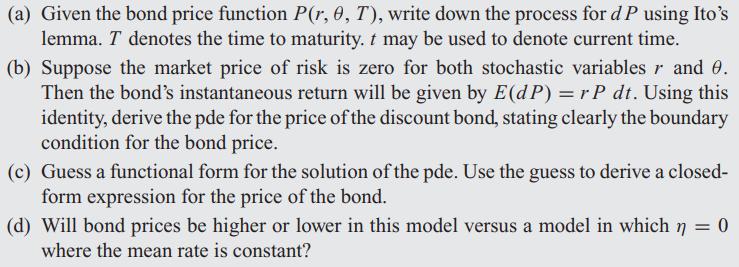

The Brownian motion d B is the same for both the interest rate r and its mean level θ. Answer the following questions:

dr = k(0-r) dt + o dB de = n dB

Step by Step Solution

3.52 Rating (149 Votes )

There are 3 Steps involved in it

Such a stochastic mean model of interest rates is studied in Balduz... View full answer

Get step-by-step solutions from verified subject matter experts