Suppose ABC stock has the following prices over the past 13 quarters: a. Calculate the stock's average

Question:

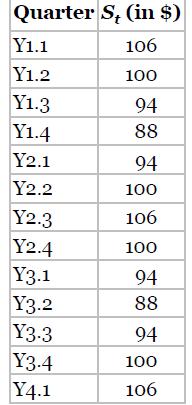

Suppose ABC stock has the following prices over the past 13 quarters:

a. Calculate the stock's average logarithmic return and variance.

b. What is the stock's annualized mean and variance?

c. Calculate the stock's up and down parameters ( \(u\) and \(d\) ) for periods with the following lengths:

i. One quarter

ii. One month

iii. One week (assume 12 weeks in a quarter)

iv. One day (assume 90 days in a quarter)

d. Using the BOPM Excel Program determine the equilibrium price for an \(\mathrm{ABC} 100\) call expiring in three months for binomial periods of length one quarter, one month, and one day. Assume the stock is currently priced at \(\$ 100\) and the annual risk-free rate is \(6 \%\).

e. Using the BOPM Excel Program determine the equilibrium price for an \(\mathrm{ABC} 100\) European put on the stock expiring in three months for binomial periods of length one quarter, one month, and one day. Assume the stock is currently priced at \(\$ 100\) and the annual risk-free rate is \(6 \%\). Are the binomial put prices consistent with put-call parity?

f. Suppose the 100 put were American. Using the BOPM Excel Program determine the equilibrium prices for the American put for periods of lengths one month \((n=3)\) and one day \((n=90)\). Assume the stock price is \(\$ 100\), the put expires in three months, and the annual risk-free rate is \(6 \%\). Do the binomial put prices for the American put differ from the European values you calculate? If so, why?

Step by Step Answer: