The initial spot rate curve (annual compounding) for three years is given as After an assessment of

Question:

The initial spot rate curve (annual compounding) for three years is given as

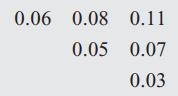

After an assessment of volatilities and interest rate propagation in the future, your quant team provides the following tree of spot rates at times 0, 1, 2 years:

This means that from a starting rate of 6%, one-year spot rates will move up to 8% or down to 5%. From 8%, the move will be to 11% or 7%, etc.

What risk-neutral probabilities should be put on the tree so that the tree is free from arbitrage? You are given one restriction, i.e., the probability of an up move in rates may be different in each time period but is the same across all nodes in any given time period.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: