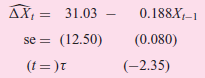

From the U.K. private sector housing starts (X) for the period 1948 to 1984, Terence Mills obtained

Question:

The 5 percent critical Ï„ value is ˆ’2.95 and the 10 percent critical Ï„ value is ˆ’2.60.

a. On the basis of these results, is the housing starts time series stationary or nonstationary? Alternatively, is there a unit root in this time series? How do you know?

b. If you were to use the usual t test, is the observed t value statistically significant? On this basis, would you have concluded that this time series is stationary?

c. Now consider the following regression results:

where Δ2 is the second difference operator, that is, the first difference of the first difference. The estimated τ value is now statistically significant. What can you say now about the stationarity of the time series in question? Note: The purpose of the preceding regression is to find out if there is a second unit root in the time series.

Step by Step Answer: