Question: This question is based on the EViews file HEDGE.WF1 which contains daily data on the percentage returns of seven hedge fund indexes, from the 1st

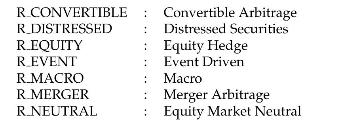

This question is based on the EViews file HEDGE.WF1 which contains daily data on the percentage returns of seven hedge fund indexes, from the 1st of April 2003 to the 28th of May 2010, a sample size of \(T=1869\).

(a) Using the returns on the Merger hedge fund estimate the constant mean model \[ R_{-} M E R G E R_{t}=\gamma_{0}+u_{t} \]

and interpret the time series properties of \(\widehat{u}_{t}\) and \(\widehat{u}_{t}^{2}\), where \(\widehat{u}_{t}\) is the demeaned return.

(b) Compute the empirical distribution of \(\widehat{u}_{t}\). Perform a test of normality and interpret the result.

(c) Test for ARCH of orders \(p=1,2,5,10\), in the Merger hedge fund returns.

(d) Repeat parts (a) and (b) for the other six hedge funds.

R.CONVERTIBLE R_DISTRESSED R_EQUITY R EVENT Convertible Arbitrage Distressed Securities Equity Hedge : Event Driven R.MACRO : R.MERGER R.NEUTRAL Macro Merger Arbitrage Equity Market Neutral

Step by Step Solution

3.48 Rating (151 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts