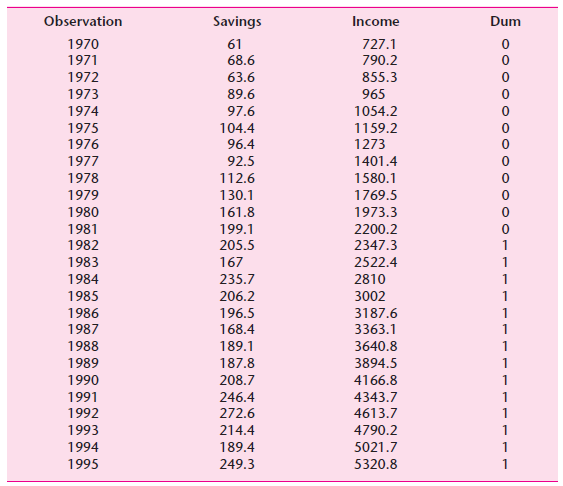

Question: Use the data given in the following table and consider the following model: ln Savings i = β 1 + β 2 ln Income i

ln Savingsi = β1 + β2 ln Incomei + β3 ln Di + ui

where ln stands for natural log and where Di = 1 for 1970€“1981 and 10 for 1982€“1995.

a. What is the rationale behind assigning dummy values as suggested?

b. Estimate the preceding model and interpret your results.

c. What are the intercept values of the savings function in the two subperiods and how do you interpret them?

Observation Savings Income Dum 1970 61 727.1 68.6 63.6 1971 790.2 855.3 1972 1973 89.6 965 1974 97.6 1054.2 1975 104.4 1159.2 1976 96.4 1273 1977 92.5 1401.4 1978 112.6 1580.1 1979 130.1 1769.5 1980 161.8 1973.3 2200.2 2347.3 1981 199.1 1982 205.5 1983 167 2522.4 2810 1984 235.7 1 1985 206.2 3002 3187.6 1986 196.5 1987 168.4 3363.1 1988 189.1 3640.8 3894.5 1989 187.8 208.7 1990 4166.8 1991 246.4 4343.7 4613.7 1992 272.6 1 1993 214.4 4790.2 1994 189.4 5021.7 1995 249.3 5320.8

Step by Step Solution

3.35 Rating (185 Votes )

There are 3 Steps involved in it

a Since the dummy enters in the log form and since the log of zero is undefined by redefining the du... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (2 attachments)

1529_605d88e1d17e3_656603.pdf

180 KBs PDF File

1529_605d88e1d17e3_656603.docx

120 KBs Word File