Alternatives 1, 2, and 3 have lives of 3, 4, and 6 years, respectively. Their net cash

Question:

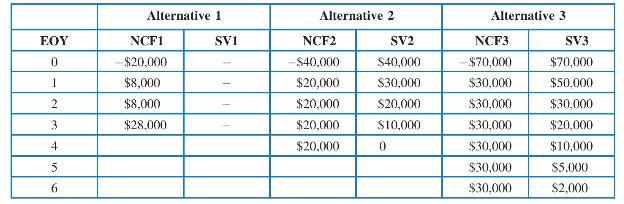

Alternatives 1, 2, and 3 have lives of 3, 4, and 6 years, respectively. Their net cash flow (NCF) and salvage value (SV) profiles are as follows:

Additional explanation is necessary: the NCF profile of Alternative 1 that is shown above is the net result of a \(\$ 20,000 /\) year lease payment payable at the beginning of each year, plus an end-of-year net revenue of \(\$ 28,000\). This lease arrangement may be renewed in 3-year increments; however, premature cancellation of the lease results in a lease termination penalty (cost) of \(\$ 10,000\) at the time of cancellation.

The NCFs of all other alternatives are expected to repeat indefinitely as shown.

a. If a least-common-multiple-of-lives approach is to be used, specify the planning horizon and the complete set of cash flows for each alternative.

b. Repeat (a) using the shortest life approach.

c. Repeat (a) using the longest life approach.

d. Repeat (a) using a standard planning horizon of 2 years.

e. Repeat (a) using a standard planning horizon of 5 years.

Step by Step Answer:

Principles Of Engineering Economic Analysis

ISBN: 9781118163832

6th Edition

Authors: John A. White, Kenneth E. Case, David B. Pratt