Yaesu America wishes to enhance their already fine line of electronic equipment for commercial and individual use.

Question:

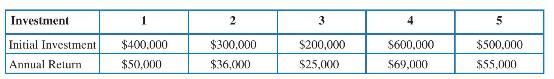

Yaesu America wishes to enhance their already fine line of electronic equipment for commercial and individual use. Their engineering staff has proposed five independent, indivisible, equal-lived investments, cutting across different product lines, with each estimated to return the initial investment if it is exited after a 5-year planning horizon. In addition, each year, Yaesu is projected to receive an annual return as noted below. They have available \(\$ 1,250,000\) to invest, and their MARR is 10 percent.

For the original problem:

a. Which alternatives should Yaesu America select as optimal?

b. What is the present worth for the selected portfolio?

c. What is the IRR for the optimum set of investments?

In addition to the original problem statement, Yaesu America has noted that Investment 4 is contingent on Investment 2.

d. Now, which alternatives should be selected?

e. What is the present worth for the portfolio?

f. What is the IRR for the portfolio?

Consider the original opportunity statement using SOLVER for sensitivity analysis:

g. Determine the optimum portfolio (state the investments selected and the portfolio PW) using (1) the current limit on investment capital, (2) plus 20 percent, and (3) minus 20 percent.

h. Determine the optimum portfolio (state the investments selected and the portfolio PW) using (1) the current MARR, (2) plus 20 percent, and (3) minus 20 percent.

Step by Step Answer:

Principles Of Engineering Economic Analysis

ISBN: 9781118163832

6th Edition

Authors: John A. White, Kenneth E. Case, David B. Pratt