Select a public company that has reported a goodwill impairment in its 10-K report. Possible companies to

Question:

Select a public company that has reported a goodwill impairment in its 10-K report.

Possible companies to consider are Baker Hughes Co., A&T Inc., Uber Technologies, Carnival Corporation, Tapestries Inc., Procter & Gamble, Lumen Technologies, and Dollar Tree Inc.

Using the company’s balance sheets from the 10-K report:

Describe and analyze the firm’s working capital components.

Identify the impact of goodwill impairment on the company’s balance sheet, and discuss how this impairment would also impact the company’s income statement and statement of cash flows for 2021. Incorporate in your analysis any other relevant information on goodwill provided in the 10-K report, including notes to the financial statements.

The following sample analysis is based on the 10-K Report of Xerox Holdings Corporation for the year ended December 31, 2021.

From the Executive Overview Although our financial results are expected to improve in 2022, our earnings for 2021 include an after-tax noncash goodwill impairment charge of \($750\) million. This charge largely reflects the impact of the economic disruption caused by the COVID-19 pandemic has had and is expected to continue to have on the Xerox print business.

From Notes to Consolidated Financial Statements, Note 1—Basis of Presentation and Summary of Significant Accounting Policies Goodwill represents the excess of the purchase price over the fair value of acquired net assets in a business combination, including the amount assigned to identifiable intangible assets. The primary drivers that generate goodwill are the value of synergies between the acquired entities and the company and the acquired assembled workforce, neither of which qualifies as an identifiable intangible asset. Goodwill is not amortized but rather is tested for impairment annually, or more frequently whenever events or changes in circumstances indicate that the carrying value of the asset may not be recoverable and an impairment loss may have been incurred.

We assess goodwill for impairment at least annually, during the fourth quarter based on balances as of October 1, and more frequently if indicators of impairment exist or if a decision is made to sell or exit a business. Impairment testing for goodwill is done at the reporting unit level. A reporting unit is an operating segment or one level below an operating segment (a component) if the component constitutes a business for which discrete financial information is available and segment management regularly reviews the operating results of that component. Consistent with the determination that we had one operating segment, we determined that there is one reporting unit and tested goodwill for impairment at the entity level.

We perform an assessment of goodwill, utilizing either a qualitative or quantitative impairment test. The qualitative impairment test assesses several factors to determine whether it is more likely than not that the fair value of the entity is less than its carrying amount. If we conclude it is more likely than not that the fair value of the entity is less than its carrying amount, a quantitative fair value test is performed. In certain circumstances, we may also bypass the qualitative test and proceed directly to a quantitative impairment test. In a quantitative impairment test, we assess goodwill by comparing the carrying amount of the entity to its fair value.

Fair value of the entity is determined by using a weighted combination of an income approach and a market approach. If the fair value exceeds the carrying value, goodwill is not considered impaired. If the carrying value exceeds the fair value, goodwill is considered impaired and we would recognize an impairment loss for the excess.

The COVID-19 pandemic continued to have a significant effect on the company’s operations impacting revenues, expenses, cash flows, and market capitalization in 2021. Although business results improved in the first half of 2021 and the company was meeting expectations, the emergence of new COVID-19 variants during the year resulted in many of our customers delaying their plans to return employees to workplaces and allowing employees to continue to work remotely and in a hybrid environment. This impact, combined with the global supply chain and logistic issues, created in part by the COVID-19 pandemic, had a negative effect on the company’s results, particularly in the third and fourth quarters of 2021. As a result of these impacts and projections of these impacts on our future operating results, as well as a sustained market capitalization below book value, we elected to utilize a quantitative model for assessing the recoverability of our Goodwill balance for our annual fourth quarter 2021 impairment test. After completing our annual impairment test, we concluded that the fair value of the company—our single reporting unit—had declined below its carrying value. As a result, we recognized an after-tax noncash impairment charge of \($750\) (\($781\) pretax) related to our goodwill for the year ended December 31, 2021.

Additional information relevant to the analysis:

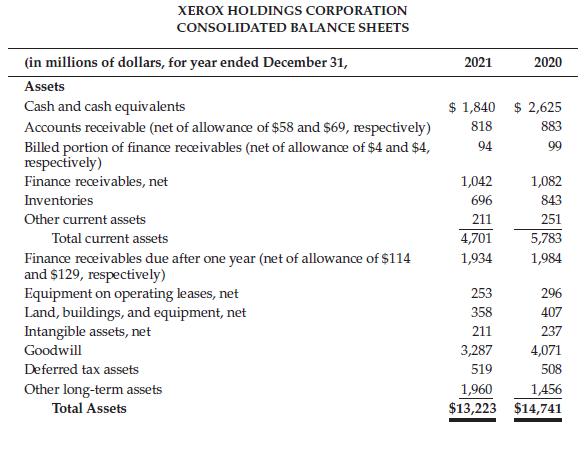

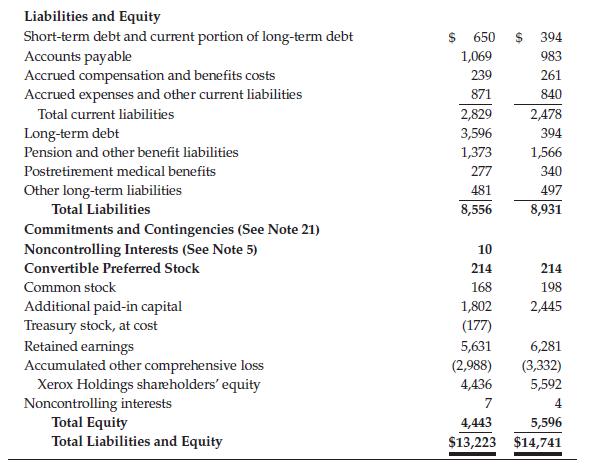

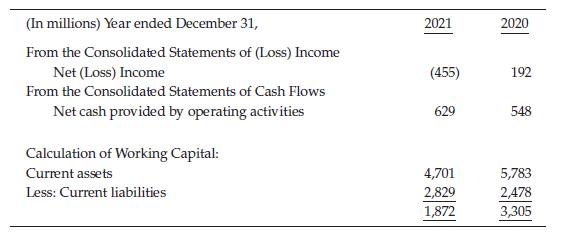

An analysis of the working capital accounts for Xerox reveals that working capital has declined between year-end 2020 and 2021, primarily due to the reduction in cash and cash equivalents (a current asset) and an increase in the current portion of long-term debt (a current liability). The company reported a net loss on its income statement of \($455\) million.

The firm needs working capital to sustain its ongoing operations, so it is important for the analyst to consider the overall liquidity of the firm. Although the cash balance is reduced in 2021, the balance of cash and cash equivalents remains solid at almost \($2,000\) million, and cash flow from operations increased by \($81\) million in 2021 to \($629\) million, which is positive for assessment of overall liquidity. As Xerox recovers from the COVID-19 pandemic, it is essential that the firm continue this improved trend in operating cash flow.

The big drain on reported income is the recognition of a goodwill impairment of \($750\) million, which according to the “Executive Overview” is the result of the pandemic’s impact on the company’s printing business. Goodwill is carried on the books when a company pays more in an acquisition than the net asset value of the business acquired; this has apparently been the case for Xerox. Once a year, the company has to assess this recognized value of goodwill and write down the amount as an impairment if the carrying value exceeds the fair value of the net assets, which has happened for Xerox in 2021. Management attributes the loss to economic disruption caused by COVID-19 and subsequent supply chain issues.

The impairment of goodwill can be seen on the balance sheet as the intangible asset goodwill account is reduced from \($4,071\) million in 2020 to \($3,287\) million in 2021, \($781\) pretax and \($750\) after tax. (The actual calculation on the balance sheet is \($784\) pretax.) Xerox Holdings income statement reflects the goodwill impairment of \($781.\) Without the impairment, the company would have reported positive net income instead of a loss of \($455\) million. In calculating cash flow from operations, the impairment charge is a noncash expense and is added back in the calculation of net income. The \($455\) million loss is thus offset by the impairment amount and contributes, along with the other adjustments, to a positive cash flow from operations in 2021 of \($628\) million.

In assessing the effect of the impairment, it is important to recognize that the company had to write down the amount of an asset on its balance sheet, goodwill, because the value of this business declined. The impairment had a negative effect on the firm’s reported income for the year, resulting in a reported loss for 2021. Future prospects for Xerox depend on how well the company recovers generally from the pandemic and related issues, and specifically from whatever factors contributed to the impairment.

Step by Step Answer:

Understanding Financial Statements

ISBN: 9780138114404

12th Edition

Authors: Lyn Fraser, Aileen Ormiston