Consider an economy with (N) banks, indexed by (i=1,2, ldots, N), and a continuum of depositors whose

Question:

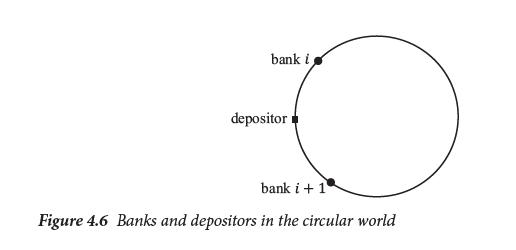

Consider an economy with \(N\) banks, indexed by \(i=1,2, \ldots, N\), and a continuum of depositors whose population is normalized to \(D\). The depositors are evenly distributed along a circular street, as Figure 4.6 shows. The circumference of the street is normalized to 1.

Each depositor has one unit of endowment. Banks collect endowments from depositors and invest the deposits in a production technology with a constant rate of return \(r\). To reach a bank and deposit, a depositor must incur a transaction cost of \(c\) for

each unit of distance between her location and the bank's office. For each bank \(i\), a fixed cost \(f\) must be paid to open its office.

(a) Assume that, in the beginning of the world, a social planner creates the banking system by locating the banks symmetrically along the street. Compute the total social cost of the banking system, i.e., the sum of banks' total fixed costs and depositors' total transaction costs.

(b) What is the optimal number of banks, if the planner aims to minimize the social cost of the banking system? From now on, assume that, without any social planner, the entry to the banking system is free in the beginning of the world, i.e., \(N\) banks simultaneously locate themselves and open their offices along the street. Banks attract depositors in their neighborhood by offering deposit rates \(r_{D}^{i}, i=1,2, \ldots, N\).

(c) Consider two neighboring banks, \(i\) and \(i+1\), as Figure 4.6 shows. Define the marginal depositor living between the two banks as a depositor who is indifferent between going to bank \(i\) or bank \(i+1\), under their offered deposit rates, \(r_{D}^{i}\) and \(r_{D}^{i+1}\). Compute the distance between the marginal depositor and bank \(i\), and total deposit supply to this bank.

(d) What is the optimal deposit rate \(r_{D}^{i}\) that maximizes bank \(i\) 's profit, taking its neighbors' deposit rates as given? Assume that all banks are symmetric, compute the equilibrium market deposit rate and each bank's profit.

(e) Free-entry implies that a bank is willing to enter the banking system as long as its profit fully covers the fixed cost \(f\). What is the number of banks in equilibrium under free-entry? Is it different from the result in question (b)?

Step by Step Answer: