The economy has (N) banks, indexed by (i=1,2, ldots, N), and a continuum of depositors whose population

Question:

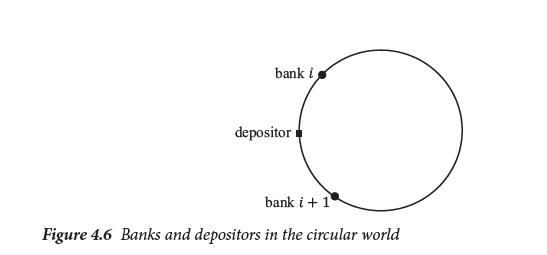

The economy has \(N\) banks, indexed by \(i=1,2, \ldots, N\), and a continuum of depositors whose population is normalized to 1. Both banks and depositors are symmetrically distributed along a circular street, as Figure 4.6 shows. The circumference of the street is normalized to 1. To reach a bank and deposit, a depositor must incur a transaction cost of \(c\) for each unit of distance between her location and the bank's office.

The time horizon is infinite over day \(t, t=0,1, \cdots,+\infty\). Banks are infinitely lived, as long as they are not bankrupted; while in each day a generation of depositors, whose population is 1, are born in the morning and die in the night. Each depositor is born with one unit of endowment; depositors deposit in banks in the morning, hoping to withdraw in the evening for consumption. Every morning banks collect endowments from depositors and invest the deposits in one of the two assets; then in the evening the assets return so that banks collect the returns to repay depositors. Similar to the Hellmann-Murdock-Stiglitz model, two types of assets are available for banks:

- Prudent asset, with a net return \(\alpha\), and

- Gambling asset, with a net return of \(\gamma\) with probability \(\theta\) and 0 with probability \(1-\theta\).

The prudent asset has higher expected return, \(\alpha>\theta \gamma\), but if the gamble succeeds the bank earns higher private return, \(\gamma>\alpha\). When the gamble fails, the bank will lose its license of banking from the next period onward. Banks' discount factor is \(0

A bank is required to hold at least \(k_{0}\) capital for each unit of deposits it collects. Capital providers, or, shareholders of banks are infinitely lived agents, and they require a return \(ho, ho>\alpha\) on bank capital.

(a) Assume that each morning, a representative bank \(i\) chooses its capital ratio \(k_{i}, k_{i} \geq k_{0}\) and deposit rate \(r_{i}\). Then all banks invest in prudent asset.

i. For a depositor located at distance \(x\) from bank \(i\), towards bank \(i+1\), what \(r_{i}\) makes the depositor indifferent between going to bank \(i\) and bank \(i+1\) ? Given that all banks are symmetric in setting deposit rate \(r\), compute the demand for deposits of bank \(i\).

ii. Specify the optimization problem for bank \(i\) who aims to maximize its franchise value. What is the bank's optimal choice on \(k\) ?

iii. What is the equilibrium deposit rate under such optimal \(k\) ? What is the bank's franchise value?

(a) Assume that each morning, a representative bank \(i\) chooses its capital ratio \(k_{i}, k_{i} \geq k_{0}\) and deposit rate \(r_{i}\). Then all banks invest in gambling asset.

i. Specify the optimization problem for bank \(i\) who aims to maximize its franchise value. What is the bank's optimal choice on \(k\) ?

ii. What is the equilibrium deposit rate under such optimal \(k\) ? What is the bank's franchise value?

(c) Market equilibria and optimal capital requirement

i. Define a market equilibrium as prudent equilibrium, if all banks coordinate to choose prudent assets, and no bank has the incentive to deviate and choose gambling assetseven for just one day. Specify the condition under which prudent equilibrium exists.

ii. Define a market equilibrium as gambling equilibrium, if all banks coordinate to choose gambling assets, and no bank has the incentive to deviate and choose prudent assetseven for just one day. Specify the condition under which gambling equilibrium exists.

iii. Compute depositors' payoff under prudent/gambling equilibrium, as well as a bank's franchise value under prudent/gambling equilibrium. If the regulator aims to maximize social welfare as the sum of depositors' payoff and banks' franchise value, what is the regulator's optimal choice on capital requirement \(k_{0}\) ?

Step by Step Answer: