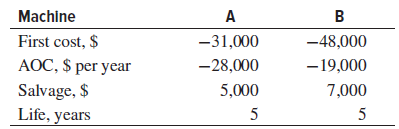

Question: Joan, the project manager, asks you to evaluate alternatives A and B on the basis of their PW values using a real interest rate of

Joan, the project manager, asks you to evaluate alternatives A and B on the basis of their PW values using a real interest rate of 10% per year and an inflation rate of 3% per year

(a) Without any adjustment for inflation,

(b) With inflation considered. Also, write the spreadsheet functions that will display the correct PW values.

(c) Joan clearly wants alternative A to be selected. If inflation is steady at 3% per year, what real return i would machine A have to generate each year to make the choice between A and B indifferent? What is the required return with inflation considered?

B Machine First cost, $ AOC, $ per year Salvage, $ Life, years A -31,000 -48,000 -28,000 -19,000 5,000 5 7,000 5

Step by Step Solution

3.26 Rating (170 Votes )

There are 3 Steps involved in it

a PW A 31000 28000PA105 5000PF105 31000 2800037908 500006209 134038 PW B 48000 19000PA105 7000PF105 ... View full answer

Get step-by-step solutions from verified subject matter experts