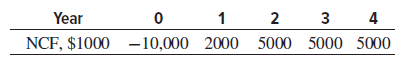

The company you work for is considering a new product line projected to have the net cash

Question:

(1) Using the company€™s market rate of 20% per year,

(2) Converting all of the estimates into CV dollars and using the company€™s real rate. You said both ways will provide the same answer, but he asked you to show him the calculations. What is the present worth by method (1) and method (2)? Solve by hand and spreadsheet.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: