Question: The manufacturing company for which you work wants to integrate a cobot (collaborative robot) into one of its production lines. Following the tender, 3

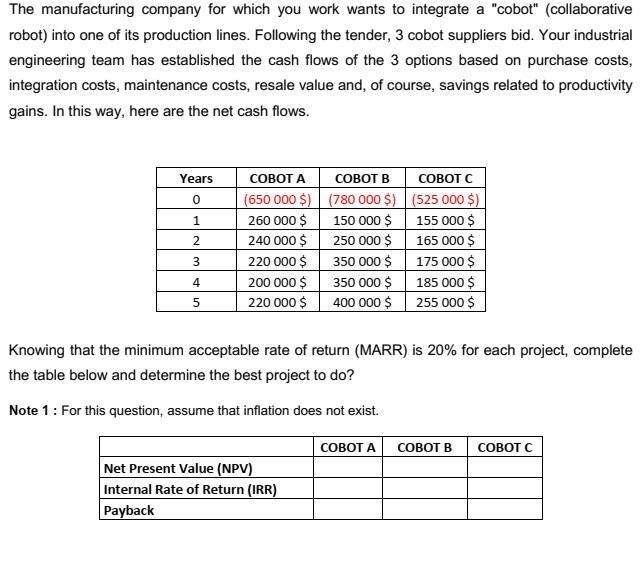

The manufacturing company for which you work wants to integrate a "cobot" (collaborative robot) into one of its production lines. Following the tender, 3 cobot suppliers bid. Your industrial engineering team has established the cash flows of the 3 options based on purchase costs, integration costs, maintenance costs, resale value and, of course, savings related to productivity gains. In this way, here are the net cash flows. Years 0 1 2 3 4 5 COBOT A (650 000 $) 260 000 $ 240 000 $ 220 000 $ 200 000 $ 220 000 $ COBOT B (780 000 $) 150 000 $ 250 000 $ 350 000 $ 350 000 $ 400 000 $ Net Present Value (NPV) Internal Rate of Return (IRR) Payback Knowing that the minimum acceptable rate of return (MARR) is 20% for each project, complete the table below and determine the best project to do? Note 1: For this question, assume that inflation does not exist. COBOT C (525 000 $) 155 000 $ 165 000 $ 175 000 $ 185 000 $ 255 000 $ COBOT A COBOT B COBOT C

Step by Step Solution

3.40 Rating (162 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts