The Castillo Products Company was started in 2014. The company manufactures components for personal digital assistant (PDA)

Question:

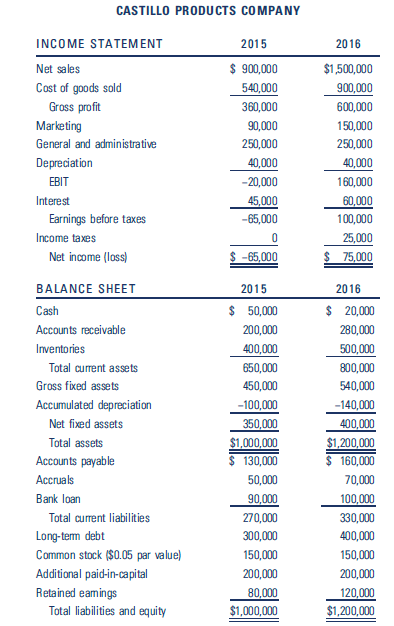

The Castillo Products Company was started in 2014. The company manufactures components for personal digital assistant (PDA) products and for other handheld electronic products. A difficult operating year, 2015, was followed by a profitable 2016. The founders (Cindy and Rob Castillo) are interested in estimating their cost of financial capital because they are expecting to secure additional external financing to support planned growth. Short-term bank loans are available at an 8 percent interest rate. Cindy and Rob believe that the cost of obtaining longterm debt and equity capital will be somewhat higher. The real interest rate is estimated to be 2 percent, and a long-run inflation premium is estimated at 3 percent. The interest rate on long-term government bonds is 7 percent. A default-risk premium

on long-term debt is estimated at 6 percent; plus Castillo Products is expecting to have to pay a liquidity premium of 3 percent due to the illiquidity associated with its long-term debt. The market risk premium on large-firm common stocks over the rate on long-term government bonds is estimated to be 6 percent. Cindy and Rob expect that equity investors in their venture will require an additional investment risk premium estimated at two times the market risk premium on large-firm common stocks. Following are income statements and balance sheets for the Castillo Products Company for 2015 and 2016.

A. Use year-end data to calculate the current ratio, the quick ratio, and the NWC-to-total-assets ratio for 2015 and 2016 for Castillo Products. What changes occurred?

B. Use Castillo Products' complete income statement data and the changes in balance sheet items between 2015 and 2016 to determine the firm's cash build and cash burn for 2016. Did Castillo Products have a net cash build or a net cash burn for 2016?

C. Convert the annual cash build and cash burn amounts calculated in Part B to monthly cash build and cash burn rates. Also indicate the amount of the net monthly cash build or cash burn rate.

Stocks or shares are generally equity instruments that provide the largest source of raising funds in any public or private listed company's. The instruments are issued on a stock exchange from where a large number of general public who are willing...

Step by Step Answer:

Entrepreneurial Finance

ISBN: 978-1305968356

6th edition

Authors: J. Chris Leach, Ronald W. Melicher