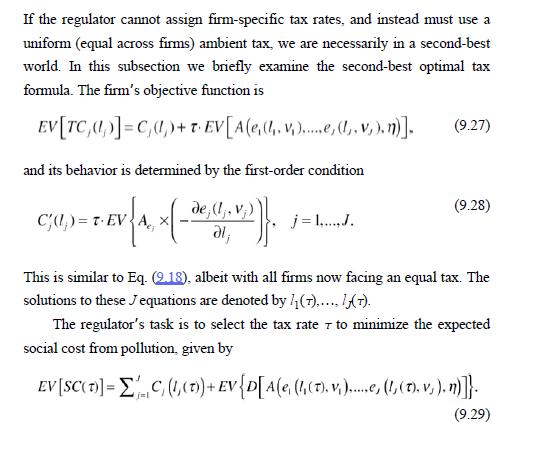

Question: Consider examples 9.2 and 9.3. Assume that social damage is quadratic as in the examples. Following section 9.2.3, assume that the regulator can only set

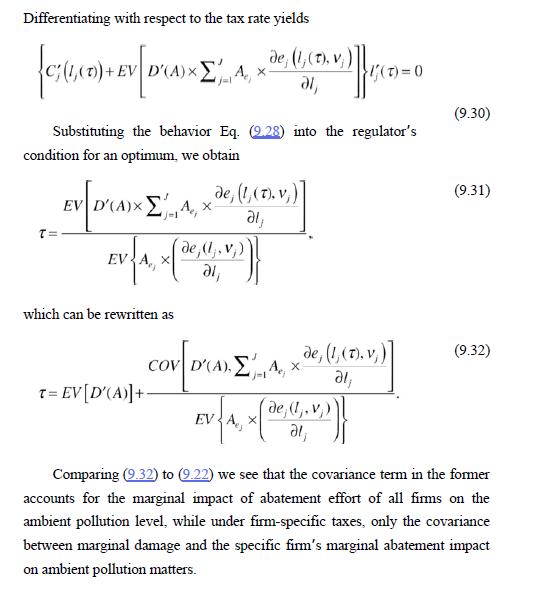

Consider examples 9.2 and 9.3. Assume that social damage is quadratic as in the examples. Following section 9.2.3, assume that the regulator can only set a uniform tax. Determine the formula for the second-best optimal tax rate.

Data from example 9.2

example 9.3

Data from section 9.2 .3

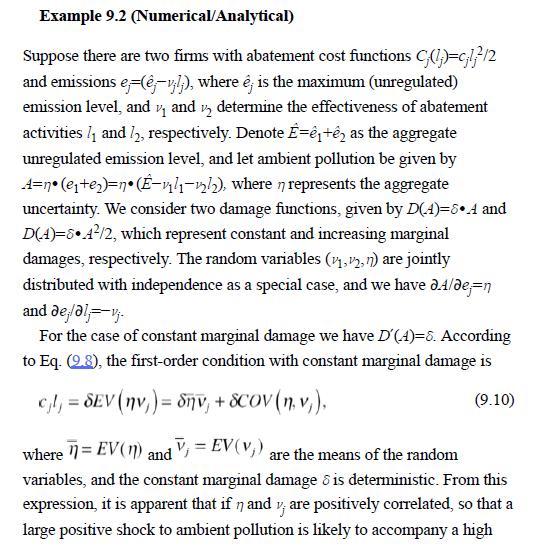

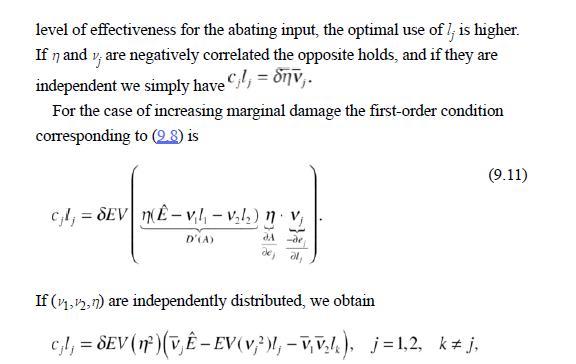

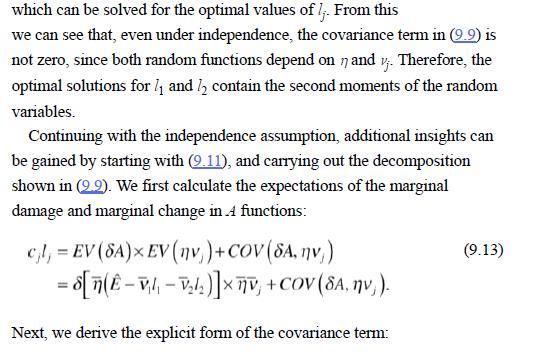

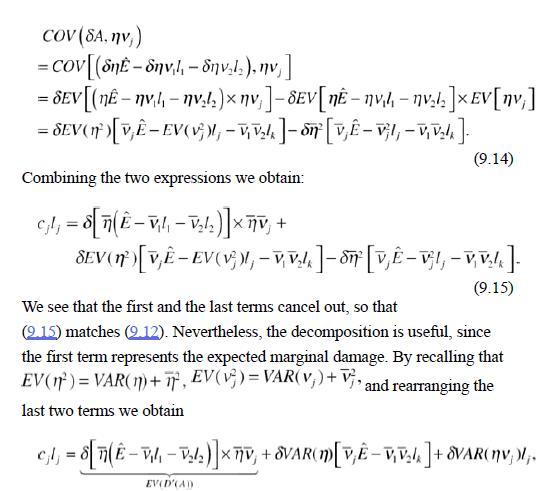

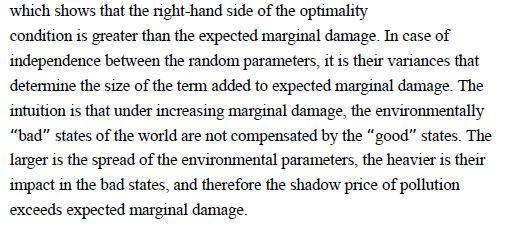

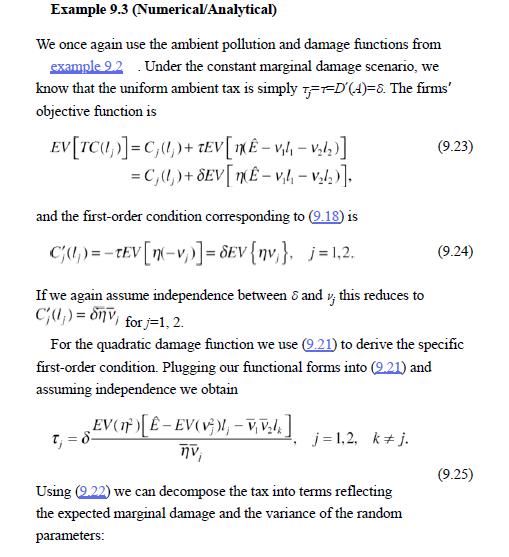

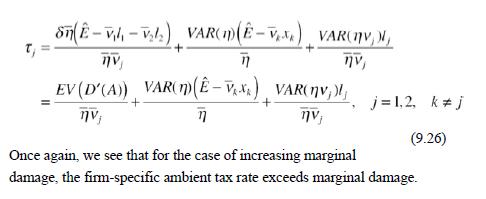

Example 9.2 (Numerical/Analytical) Suppose there are two firms with abatement cost functions C(1)=cl/2 and emissions e-(e-vlj), where e; is the maximum (unregulated) emission level, and and determine the effectiveness of abatement 1/1 activities 1 and 12, respectively. Denote =+ as the aggregate unregulated emission level, and let ambient pollution be given by A=n (e+)=n (E-vl-22), where n represents the aggregate uncertainty. We consider two damage functions, given by D(4A)=8.4 and D(4)=84/2, which represent constant and increasing marginal damages, respectively. The random variables (,2,n) are jointly distributed with independence as a special case, and we have d./de-n and defalvj. For the case of constant marginal damage we have D'(4)=6. According to Eq. (9.8), the first-order condition with constant marginal damage is cl = SEV (nv) = 8nv + SCOV (n. v), (9.10) where = EV(1) and V = EV(v) are the means of the random variables, and the constant marginal damage & is deterministic. From this expression, it is apparent that if n and v; are positively correlated, so that a large positive shock to ambient pollution is likely to accompany a high

Step by Step Solution

3.38 Rating (167 Votes )

There are 3 Steps involved in it

In the context provided the regulator is interested in setting a uniform tax that will minimize the expected social cost from pollution given the cons... View full answer

Get step-by-step solutions from verified subject matter experts