Foster and Hahn (1995) have examined trading of air pollutant emission rights within the Los Angeles air

Question:

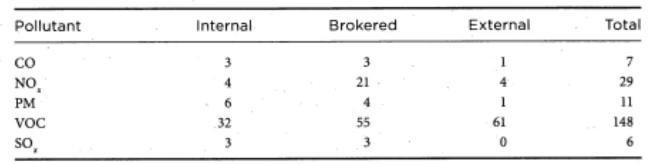

Foster and Hahn (1995) have examined trading of air pollutant emission rights within the Los Angeles air basin in 1985-1991. They hypothesized that two factors would lead to high transaction costs: exchanges of thinly traded pollutants (few trades) and exchanges involving small quantities of pollution. Transaction costs for thinly traded pollutants would be high because of the difficulty in finding someone with whom to trade. The following is a table showing the number of trades for five pollutants during the period in question in Los Angeles. Shown are trades from one factory to another within the same company ("internal"), trades involving brokers or other intermediaries ("brokered"), and trades between companies without assistance of intermediaries ("external").

a. How would you expect the transaction costs to differ among the three categories of trade: internal, brokered or external?

b. Do the data in the table support the hypothesis that transaction costs might be higher for thinly traded pollutants? Why or why not?

c. What effect would you expect the size of a trade (number of tons of pollution) to have on transaction costs (per ton of pollution)? How would you expect the size of a trade to influence whether a pollutant is more likely to be internally traded, brokered, or externally traded?

Step by Step Answer: