An analyst expects JNJs (Johnson & Johnson) dividend of ($2.40) for 2012 to grow by 7.5 percent

Question:

An analyst expects JNJ’s (Johnson & Johnson) dividend of \($2.40\) for 2012 to grow by 7.5 percent for six years and then grow by 6 percent into perpetuity. A recent price for JNJ as of late-August 2013 is \($86.97\). What is the IRR on an investment in JNJ’s stock?

In performing trial and error with the two-stage model to estimate the expected rate of return, having a good initial guess is important. In this case, the expected rate of return formula from the Gordon growth model and JNJ’s long-term growth rate can be used to find a first approximation: r = (\($2.40\) × 1.075)/\($86.97\) + 0.06 = 9 percent.

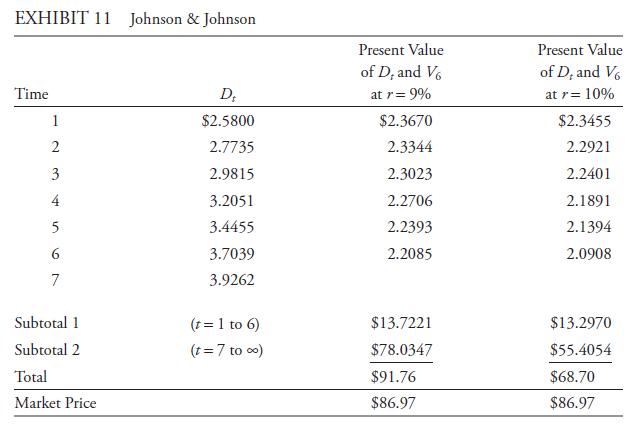

Because the growth rate in the first six years is more than the long-term growth rate of 6 percent, the estimated rate of return must be above 9 percent. Exhibit 11 shows the value estimate of JNJ for two discount rates, 9 percent and 10 percent.

In the exhibit, the first subtotal is the present value of the expected dividends for Years 1 through 6.

The second subtotal is the present value of the terminal value, V6/(1 + r)6 = [D7/(r − g)]/(1 + r)6. For r = 9 percent, that present value is [3.9262/(0.09 −

0.06)]/(1.09)6 = \($78.0347\). The present value for other values of r is found similarly.

Using 9 percent as the discount rate, the value estimate for JNJ is \($91.76\), which is about 5.5 percent larger than JNJ’s market price of \($86.97\). This fact indicates that the IRR is greater than 9 percent. With a 10 percent discount rate, the present value of \($68.72\) is significantly less than the market price. Thus, the IRR is slightly more than 9 percent. The IRR can be determined to be 9.16 percent, using a calculator or spreadsheet.

Step by Step Answer: