Assume that a company is currently paying no dividend and will not pay one for several years.

Question:

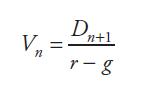

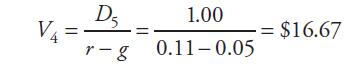

Assume that a company is currently paying no dividend and will not pay one for several years. If the company begins paying a dividend of $1.00 five years from now, and the dividend is expected to grow at 5 percent thereafter, this future dividend stream can be discounted back to find the value of the company. This company’s required rate of return is 11 percent. Because the expression

values a stock at period n using the next period’s dividend, the t = 5 dividend is used to find the value at t = 4:

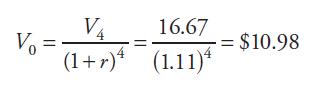

To find the value of the stock today, simply discount V4 back for four years:

The value of this stock, even though it will not pay a dividend until Year 5, is $10.98.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: