Bob Inguigiatto, CFA, has been given the task of developing mean return estimates for a list of

Question:

Bob Inguigiatto, CFA, has been given the task of developing mean return estimates for a list of stocks as preparation for a portfolio optimization. On his list is NextEra Energy, Inc. (NYSE: NEE), formerly FPL Group, Inc. On analysis, he decides that it is appropriate to model NEE using the Gordon growth model, and he takes prices as reflecting value. The company paid dividends of \($2.40\) in 2012, and the current stock price is \($80.19.\) The growth rates of dividends and earnings per share have been 7.5 percent and 10.0 percent, respectively, for the past five years. Analysts’ consensus estimate of the five-year earnings growth rate is 5.0 percent. Based on his own analysis, Inguigiatto has decided to use 5.50 percent as his best estimate of the long-term earnings and dividend growth rate. Next year’s projected dividend, D1, should be

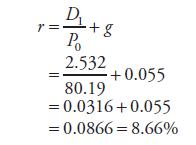

\($2.40(1.055)\) = \($2.532\) Using the Gordon growth model, NEE’s expected rate of return should be

The expected rate of return can be broken into two components, the dividend yield (D1/P0 = 3.16 percent) and the capital gains yield (g = 5.50 percent).

Step by Step Answer: