An analyst is reviewing the valuation of DuPont (NYSE: DD) as of the beginning of July 2013

Question:

An analyst is reviewing the valuation of DuPont (NYSE: DD) as of the beginning of July 2013 when DD is selling for \($52.72\) . In the previous year, DuPont paid a \($1.70\) dividend that the analyst expects to grow at a rate of 4 percent annually for the next four years. At the end of Year 4, the analyst expects the dividend to equal 35 percent of earnings per share and the trailing P/E for DD to be 13. If the required return on DD common stock is 9.0 percent, calculate the per-share value of DD common stock.

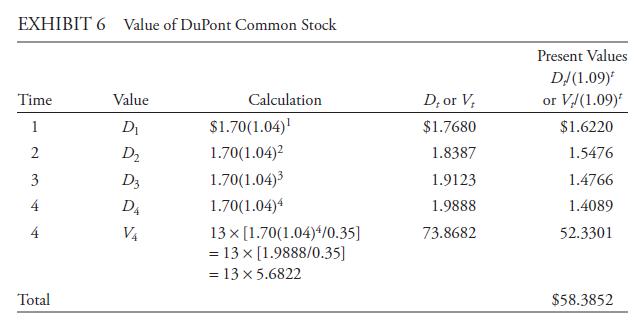

Exhibit 6 summarizes the relevant calculations. When the dividends are growing at 4 percent, the expected dividends and the present value of each (discounted at 9.0 percent) are shown. The terminal stock price, V4, deserves some explanation. As shown in the table, the Year 4 dividend is 1.70(1.04)4 = 1.9888. Because dividends at that time are assumed to be 35 percent of earnings, the EPS projection for Year 4 is EPS4 = D4/0.35 = 1.9888/0.35 = 5.6822. With a trailing P/E of 13.0, the value of DD at the end of Year 4 should be 13.0(5.6822) = \($73.8682\). Discounted at 9 percent for four years, the present value of V4 is \($52.3301\).

The present values of the dividends for Years 1 through 4 sum to \($6.06\). The present value of the terminal value of \($73.87\) is \($52.33\) . The estimated total value of DD is the sum of these, or \($58.39\) per share.

Step by Step Answer: