Christie Johnson, CFA, has been assigned to analyze Sundanci. Johnson assumes that Sundancis earnings and dividends will

Question:

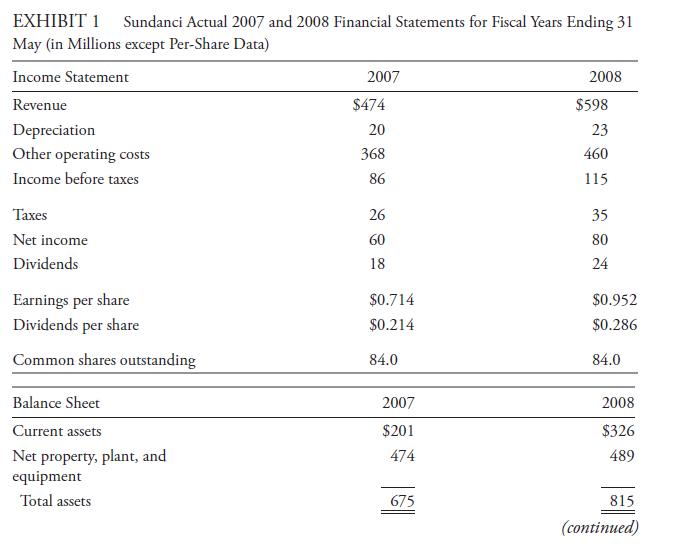

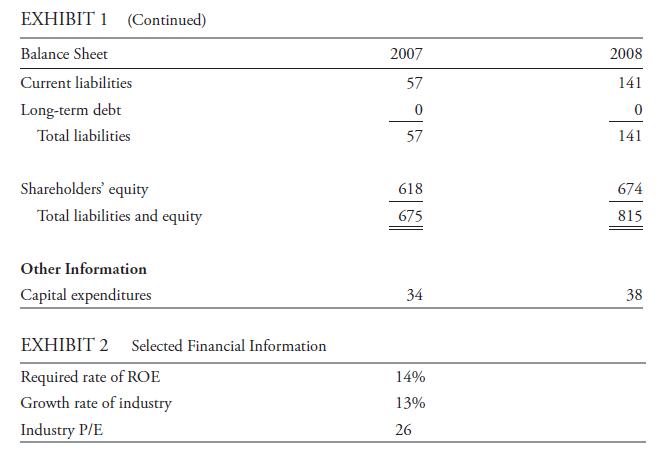

Christie Johnson, CFA, has been assigned to analyze Sundanci. Johnson assumes that Sundanci’s earnings and dividends will grow at a constant rate of 13 percent. Exhibits 1 and 2 provide financial statements for the most recent two years (2007 and 2008) and other information for Sundanci.

A. Based on information in Exhibits 1 and 2 and on Johnson’s assumptions for Sundanci, calculate justified trailing and forward P/Es for this company.

B. Identify, within the context of the constant dividend growth model, how each of the following fundamental factors would affect the P/E:

1) The risk (beta) of Sundanci increases substantially.

2) The estimated growth rate of Sundanci’s earnings and dividends increases.

3) The equity risk premium increases.

Step by Step Answer: