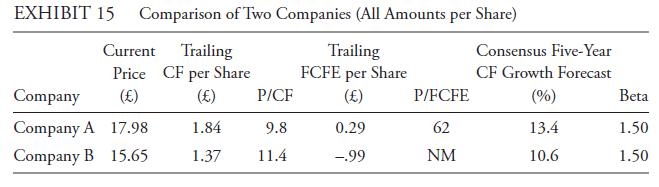

Exhibit 15 provides information on P/CF, P/FCFE, and selected fundamentals as of 16 April 2012 for two

Question:

Exhibit 15 provides information on P/CF, P/FCFE, and selected fundamentals as of 16 April 2012 for two hypothetical companies. Using the information in Exhibit 15, compare the valuations of the two companies.

Company A is selling at a P/CF (9.8) approximately 14 percent smaller than the P/CF of Company B (11.4). Based on that comparison, we expect that, all else equal, investors would anticipate a higher growth rate for Company B. Contrary to that expectation, however, the consensus five-year earnings growth forecast for Company A is 280 basis points higher than it is for Company B. As of the date of the comparison, Company A appears to be relatively undervalued compared with Company B, as judged by P/CF and expected growth. The information in Exhibit 15 on FCFE supports the proposition that Company A may be relatively undervalued. The positive FCFE for Company A indicates that operating cash flows and new debt borrowing are more than sufficient to cover capital expenditures. Negative FCFE for Company B suggests the need for external funding of growth.

Step by Step Answer: