Janet Larsen manages an institutional portfolio and is currently looking for new stocks to add to the

Question:

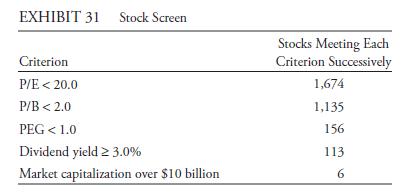

Janet Larsen manages an institutional portfolio and is currently looking for new stocks to add to the portfolio. Larsen has a commercial database with information on US stocks. She has designed several screens to select stocks with low P/Es and low P/B multiples. Because Larsen is aware that screening for low P/E and low P/B multiples may identify stocks with low expected growth, she also wants stocks that have a PEG less than 1.0. She decides to screen for stocks with a dividend yield of at least 3.0 percent and a total market capitalization over \($10\) billion. Exhibit 31 shows the number of stocks that successively met each of the five criteria as of January 2014 (so, the number of stocks that met all five criteria is 6).

Other information:

• The screening database indicates that the P/E was 19.4, P/B was 2.6, and the dividend yield was 2.1 percent for the S&P 500 as of the date of the screen.

• S&P’s US Style Indices Methodology indicates that the style indices measure growth and value by the following six factors, which S&P standardizes and uses to compute growth and value scores for each company:

Three Growth Factors Three-year change in EPS over price per share Three-year sales per share growth rate Momentum (12-month percentage price change)

Three Value Factors Book value to price ratio Earnings to price ratio Sales to price ratio. In July of 2013, the S&P Dow Jones US Index Committee raised the market cap guidelines used when selecting companies for the S&P 500, S&P Mid-Cap 400, and S&P Small-Cap 600.

The new guidelines are:

S&P 500: Over \($4.6\) billion S&P Mid-Cap 400: \($1.2\) to \($5.1\) billion S&P Small-Cap 600: \($350\) million to \($1.6\) billion Using the information supplied, answer the following questions:

i. What type of valuation indicators does Larsen not include in her stock screen?

ii. Characterize the overall orientation of Larsen as to investment style.

iii. State two limitations of Larsen’s stock screen.

Step by Step Answer: