Suppose that an analyst needs to identify the peer group of companies for Brinks Home Security for

Question:

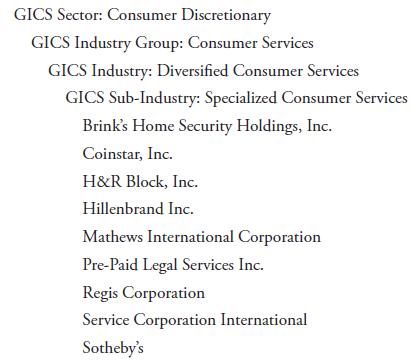

Suppose that an analyst needs to identify the peer group of companies for Brink’s Home Security for use in the valuation section of a company report. Brink’s is a provider of electronic security and alarm monitoring services primarily to residential customers in North America. The analyst starts by looking at Brink’s industry classification according to GICS. As previously discussed, the most narrowly defined category that GICS uses is the sub-industry level, and in June 2009, Brink’s was in the GICS sub-industry called Specialized Consumer Services, together with the companies listed here:

After looking over the list of companies, the analyst quickly realizes that some adjustments need to be made to the list to end up with a peer group of companies that are comparable to Brink’s. For example, Brink’s has little in common with the hair care salon services of Regis or, for that matter, with the funeral service operations of Hillenbrand, Mathews, or Service Corporation. In fact, after careful inspection, the analyst concludes that none of the other companies included in the GICS sub-industry are particularly good “comparables” for Brink’s.

Next, the analyst reviews the latest annual report for Brink’s to find management statements concerning its competitors. On p. 6 of Brink’s 2008 10-K, in the section titled “Industry Trends and Competition,” is a list of other companies with comparable business activities: “We believe our primary competitors with national scope include:

ADT Security Services, Inc., (part of Tyco International, Ltd.), Protection One, Inc., Monitronics International, Inc. and Stanley Security Solutions, (part of The Stanley Works).” The analyst notes that Protection One on this list is another publicly held security services company and a likely candidate for inclusion in the peer group for Brink’s. Monitronics International is privately held, so the analyst excludes it from the peer group; up-to-date, detailed fundamental data are not available for it.

The analyst discovers that ADT represents a significant portion of Tyco International’s sales and profits (more than 40 percent of 2008 sales and profits); therefore, an argument could be made to include Tyco International in the peer group. The analyst might also consider including Stanley Works in the peer group because that company derived roughly a third of its revenue and close to half of its operating profit from its security division in 2008. Just as the analyst reviewed the latest annual report for Brink’s to identify additional potential comparables, the analyst should also scan the annual reports of the other companies listed to see if other comparables exist. In checking these three companies’ annual reports, the analyst finds that Protection One is the only one that cites specific competitors; Tyco and Stanley Works discuss competition only broadly.

After scanning all of the annual reports, the analyst finds no additional comparables.

The analyst decides that Brink’s peer group consists of ADT Security Services, Protection One, and Stanley Security Solutions but also decides to give extra weight to the comparison with Protection One in valuation because the comparison with Protection One has the fewest complicating factors.

In connection with this discussion, note that International Financial Reporting Standards and US GAAP require companies to disclose financial information about their operating segments (subject to certain qualifications). Such disclosures provide analysts with operational and financial information that can be helpful in peer-group determination.

Step by Step Answer: