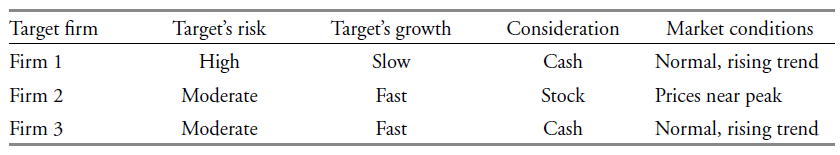

The guideline transaction that is most likely applicable to FAMCO is A. Firm 1. B. Firm 2.

Question:

A. Firm 1.

B. Firm 2.

C. Firm 3.

The senior vice president of acquisitions for Northland Industries, Angela Lanton, and her head analyst, Michael Powell, are evaluating several potential investments. Northland is a diversified holding company for numerous businesses. One of Northland€™s divisions is a manufacturer of fine papers and that division has alerted Lanton about Oakstar Timber, a supplier that may be available for purchase. Oakstar€™s sole owner, Felix Tanteromo, has expressed interest in exchanging his ownership of Oakstar for a combination of cash and Northland Industries securities.

Oakstar€™s main asset is 10,000 hectares of timberland in the western part of Canada.

The land is a combination of new- and old-growth Douglas fir trees. The value of this timberland has been steadily increasing since Oakstar acquired it. Oakstar manages the land on a sustained yield basis (i.e., so it continues to produce timber indefinitely) and contracts with outside forestry companies to evaluate, harvest, and sell the timber. Oakstar€™s income is in the form of royalties (fees paid to Oakstar based on the number of cubic meters harvested).

Oakstar€™s balance sheet as of 31 December 2008 is as follows.

Oakstar Timber Balance Sheet Year Ended 31 December 2008

Assets

Cash ...........................................................................................$500,000

Inventory ........................................................................................25,000

Accounts receivable .......................................................................50,000

Plant and equipment (cost less depreciation) ..............................750,000

Land ........................................................................................10,000,000

Total assets ...........................................................................$11,325,000

Liabilities and Equity

Accounts payables ......................................................................$75,000

Long-term bank loan ................................................................1,500,000

Common stock .........................................................................9,750,000

Total liabilities and equity ......................................................$11,325,000

In addition to the balance sheet, Powell is gathering other data to assist in valuing Oakstar and has found information on recent sales of timberland in the western part of Canada. Douglas fir properties have averaged $6,178 per hectare for tracts that are not contiguous and do not have a developed road system for harvesting the timber. For tracts that have these features, as possessed by Oakstar, the average price is $8,750 per hectare. Properties near urban areas and having potential for residential and recreational second home development command up to $20,000 per hectare. Oakstar€™s land lacks this potential. Lanton believes these values would form the basis of an asset-based valuation for Oakstar, with the additional assumption that other assets and liabilities on the balance sheet are assumed to be worth their stated values.

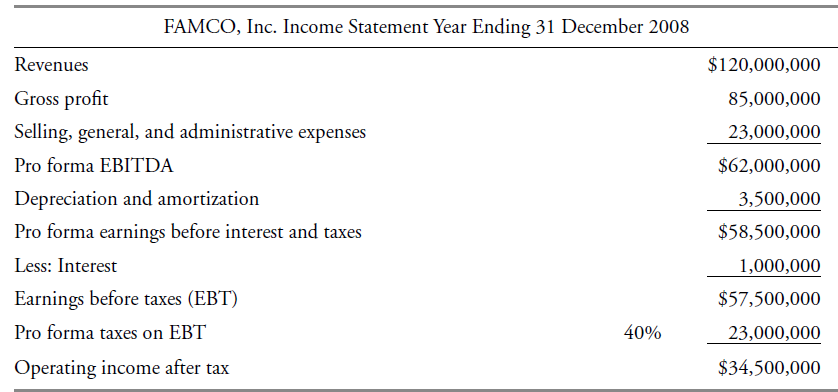

The second company under evaluation, FAMCO, Inc., is a family-owned electronic manufacturing company with annual sales of $120 million. The family wants to monetize the value of their ownership in FAMCO with a view to later investing part of the proceeds in a diversified stock portfolio. Lanton has asked Powell to obtain data for both an incomebased and market-based valuation. Powell has obtained the recent annual income statement and additional data needed to calculate normalized earnings as follows.

Additional data for FAMCO is provided in the following table. Included are estimates by Powell of the compensation paid to family members and the smaller amount of salary expense for replacement employees if Northland acquires the company (reflecting perceived above-market compensation of the family group executives). He believes the current debt of FAMCO can be replaced with a more optimal level of debt at a lower interest rate. These will be reflected in a normalized income statement.

FAMCO, Inc.

Current debt level .........................................................$10,000,000

Current interest rate ..................................................................10%

Salaries of employed family members ............................$7,000,000

Salaries of replacement employees ...............................$5,400,000

New debt level .............................................................$25,000,000

New interest rate .........................................................................8%

Powell also recognizes that a value needs to be assigned to FAMCO€™s intangibles consisting of patents and other intangible assets. Powell prepares an additional estimate of excess earnings and intangibles value using the capitalized cash flow method. He gathers the following data:

FAMCO, Inc.€”Intangibles Valuation Data

Working capital balance .........................................................$10,000,000

Fair value of fixed assets .......................................................$45,000,000

Normalized income to the company .......................................$35,000,000

Required return on working capital ........................................................8%

Required return on fixed assets ...........................................................12%

Required return on intangible assets .....................................................20%

Weighted average cost of capital ........................................................ 14.5%

Future growth rate ....................................................................................6%

Lanton asks Powell to also use the market approach to valuation with a focus on the guideline transactions method. Powell prepares a table showing relevant information regarding three recent guideline transactions and market conditions at the time of the transactions. Powell€™s assumptions about FAMCO include its expected fast growth and moderate level of risk.

Although Northland is interested in acquiring all of the stock of FAMCO, the acquisition of a 15 percent equity interest in FAMCO is also an option. Lanton asks Powell about the valuation of small equity interests in private entities and notes that control and marketability are important factors that lead to adjustments in value estimates for small equity interests. Powell mentions that the control premium paid for the most similar guideline firm used in the analysis suggests a discount for lack of control of 20 percent. The discount for lack of marketability was estimated at 15 percent.

Intangible AssetsAn intangible asset is a resource controlled by an entity without physical substance. Unlike other assets, an intangible asset has no physical existence and you cannot touch it.Types of Intangible Assets and ExamplesSome examples are patented... Balance Sheet

Balance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial... Cost Of Capital

Cost of capital refers to the opportunity cost of making a specific investment . Cost of capital (COC) is the rate of return that a firm must earn on its project investments to maintain its market value and attract funds. COC is the required rate of...

Step by Step Answer:

Equity Asset Valuation

ISBN: 978-0470571439

2nd Edition

Authors: Jerald E. Pinto, Elaine Henry, Thomas R. Robinson, John D. Stowe, Abby Cohen