Question: To recap the data from Example 3, Bugg Properties has expected earnings per share of ($2.00,) ($2.50,) and ($4.00) and expected dividends per share of

To recap the data from Example 3, Bugg Properties has expected earnings per share of

\($2.00,\) \($2.50,\) and \($4.00\) and expected dividends per share of \($1.00,\) \($1.25,\) and \($12.25\) for the next three years. Analysts expect that the last dividend will be a liquidating dividend and that Bugg will cease operating after Year 3. Bugg’s current book value per share is \($6.00,\) and its estimated required rate of return on equity is 10 percent.

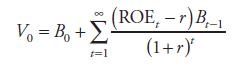

Using the above data, estimate the value of Bugg Properties’ stock using a residual income model of the form:

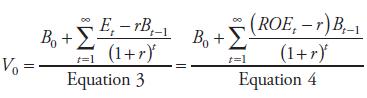

Note that the value is identical to the estimate obtained using Equation 3, as illustrated in Example 3, because the assumptions are the same and Equations 3 and 4 are equivalent expressions:

V = Bo+ IM 8 (ROE, r) B-1 (1+r)

Step by Step Solution

3.33 Rating (153 Votes )

There are 3 Steps involved in it

To value the stock forecast residual income Exhibit 3 illustrates the calcul... View full answer

Get step-by-step solutions from verified subject matter experts