Question: Wilhelm Müller, CFA, has organized the following selected data on four food companies (TTM stands for trailing 12 months): On the basis of the data

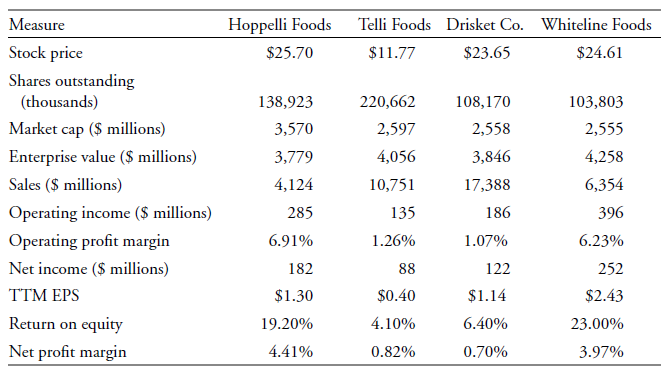

Wilhelm Müller, CFA, has organized the following selected data on four food companies (TTM stands for trailing 12 months):

On the basis of the data given, answer the following questions:

A. Calculate the trailing P/E and EV/Sales for each company.

B. Explain, on the basis of fundamentals, why these stocks have different EV/S multiples.

Telli Foods Hoppelli Foods Measure Drisket Co. Whiteline Foods Stock price $25.70 $11.77 $23.65 $24.61 Shares outstanding (thousands) 220,662 108,170 138,923 103,803 Market cap ($ millions) 3,570 2,597 2,558 2,555 Enterprise value ($ millions) 4,056 3,846 4,258 3,779 Sales ($ millions) 4,124 10,751 6,354 17,388 Operating income ($ millions) 135 186 396 285 Operating profit margin 6.91% 1.26% 6.23% 1.07% Net income ($ millions) 182 88 122 252 TTM EPS $1.30 $0.40 $1.14 $2.43 Return on equity 4.10% 6.40% 19.20% 23.00% Net profit margin 4.41% 0.82% 0.70% 3.97%

Step by Step Solution

3.52 Rating (176 Votes )

There are 3 Steps involved in it

A The PEs are Hoppelli 2570130 198 Telli 1177040 294 Drisket 2365114 207 Whiteline 2461243 1... View full answer

Get step-by-step solutions from verified subject matter experts