Question: Facebook, Inc. (FB) Nasdaqs - NasdaqGs Real Time Price. Currency in USD Add to watchlist 89 Visitors trend 2W 10W T 9M 1 Quote Lookup

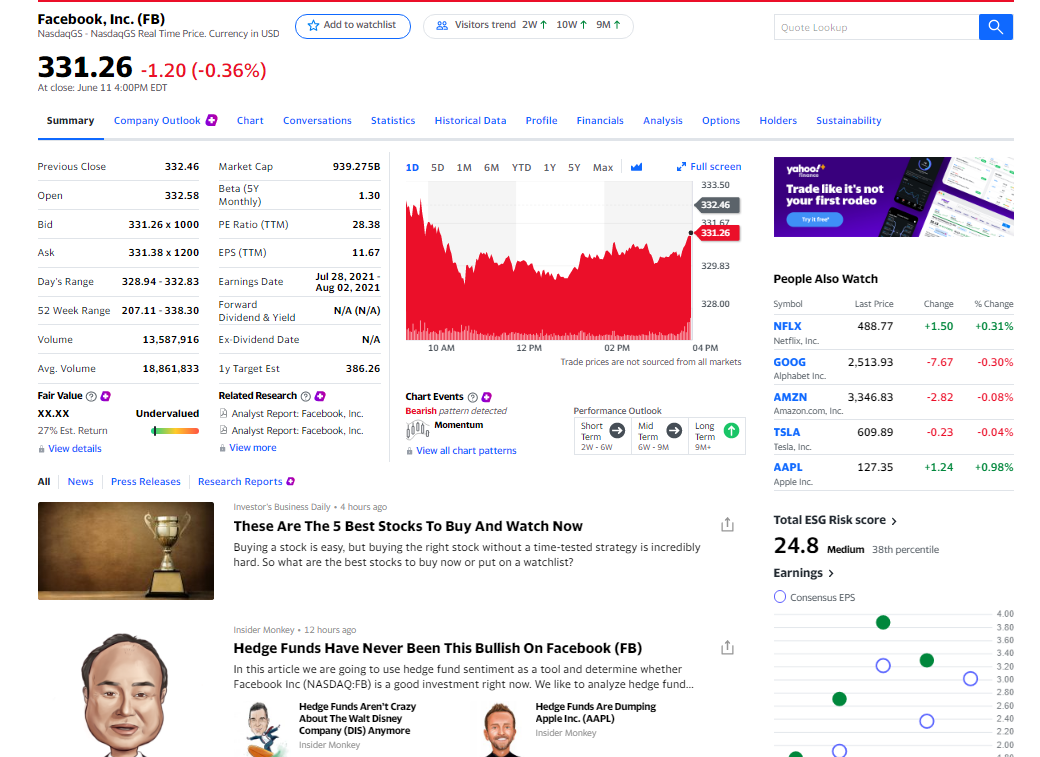

Facebook, Inc. (FB) Nasdaqs - NasdaqGs Real Time Price. Currency in USD Add to watchlist 89 Visitors trend 2W 10W T 9M 1 Quote Lookup Q 331.26 -1.20 (-0.36%) At close: June 11 4:00PM EDT Summary Company Outlook Chart Conversations Statistics Historical Data Profile Financials Analysis Options Holders Sustainability Previous Close 332.46 Market Cap 939.275B 1D 5D 1M 6M YTD 1Y SY YTD 1Y SY Max Full screen 333.50 yahoo! Trade like it's not your first rodeo Open Beta (SY Monthly) 332.58 1.30 332.46 Bid 331.26 x 1000 PE Ratio (TTM) 28.38 32152 331.26 Ask 331.38 x 1200 EPS (TTM) 11.67 329.83 Day's Range 328.94-332.83 Earnings Date Jul 28, 2021- Aug 02. 2021 People Also Watch 328.00 Symbol Last Price Change % Change 52 Week Range 207.11.338.30 Forward Dividend & Yield N/A (N/A) NFLX 488.77 +1.50 +0.31% Volume 13.587,916 Ex-Dividend Date N/A Netflix, Inc. 10 AM 12 PM 02 PM 04 PM Trade prices are not sourced from all markets GOOG 2,513.93 -7.67 -0.30% Avg. Volume 18.861,833 1y Target Est 386.26 Alphabet Inc. Fair Value -2.82 -0.08% Related Research Analyst Report: Facebook, Inc. , Chart Events Bearish pattern detected AMZN 3,346.83 Amazon.com, Inc XX.XX Undervalued Performance Outlook Mid 27% Est. Return % hool, Momentum TSLA 609.89 -0.23 Analyst Report: Facebook, Inc. View more -0.04% Shorts Term 2W-W Long Term 9M- Term 6W - 9 View details View all chart patterns Tesla, Inc 127.35 +1.24 +0.98% AAPL Apple Inc All News Press Releases Research Reports Investor's Business Daily 4 hours ago Total ESG Risk score > These Are The 5 Best Stocks To Buy And Watch Now 24.8 Medium 38th percentile Buying a stock is easy, but buying the right stock without a time-tested strategy is incredibly hard. So what are the best stocks to buy now or put on a watchlist? Earnings > O Consensus EPS 4.00 Insider Monkey. 12 hours ago 380 3.60 Hedge Funds Have Never Been This Bullish On Facebook (FB) 3.40 320 In this article we are going to use hedge fund sentiment as a tool and determine whether Facebook Inc (NASDAQ:FB) is a good investment right now. We like to analyze hedge fund... 300 2.80 2.60 Hedge Funds Aren't Crazy About The Walt Disney Company (DIS) Anymore Insider Monkey Hedge Funds Are Dumping Apple Inc. (AAPL) Insider Monkey O 2.40 220 2.00 0 Finding Basic Corporate Financial Data Online, with Yahoo Finance To answer the following questions, go to the Yahoo Finance site and look up the financial information for Facebook using its "ticker symbol" FB. You will have to access the web version of Yahoo Finance, since the mobile app version only gives a partial version of the financial data required. Fire up a calculator for this assignment, because you'll need to perform some basic arithmetic such as calculating percentages. If you are uncertain about how to calculate percentages, invest three minutes here e. If you are uncertain about calculating ratios, invest another four minutes here e. Here are the two most common mistakes to avoid on this assignment: 1) On financial statements for most companies, the dollar values given are usually in thousands - if so, it will say this in the fine print at the top of the statement. This is the case with the dollar values in Facebook's financial statements, which are in thousands, so you need to add an extra three zeros. So, a number such as $1,000,000 (one million) in fact means $1,000,000,000 (one billion). Don't confuse millions and billions! 2) Make sure you are looking at the right time period that the question is asking about. If it asks for figures for 2020, don't look up the numbers for 2019 instead. And if it asks for the latest quarterly data, don't look at the annual data instead. Notice on the web page that you can select whether to look at income statement, balance sheet or cash flow, you can also toggle between annual and quarterly figures. IGNORE THE COLUMN LABELED "TTM" (TRAILING 12 MONTHS) -- JUST LOOK AT THE COLUMNS WITH a FISCAL YEAR DATE OR FISCAL QUARTER DATE AT THE TOP OF THE COLUMN. Facebook, Inc. (FB) Nasdaqs - NasdaqGs Real Time Price. Currency in USD Add to watchlist 89 Visitors trend 2W 10W T 9M 1 Quote Lookup Q 331.26 -1.20 (-0.36%) At close: June 11 4:00PM EDT Summary Company Outlook Chart Conversations Statistics Historical Data Profile Financials Analysis Options Holders Sustainability Previous Close 332.46 Market Cap 939.275B 1D 5D 1M 6M YTD 1Y SY YTD 1Y SY Max Full screen 333.50 yahoo! Trade like it's not your first rodeo Open Beta (SY Monthly) 332.58 1.30 332.46 Bid 331.26 x 1000 PE Ratio (TTM) 28.38 32152 331.26 Ask 331.38 x 1200 EPS (TTM) 11.67 329.83 Day's Range 328.94-332.83 Earnings Date Jul 28, 2021- Aug 02. 2021 People Also Watch 328.00 Symbol Last Price Change % Change 52 Week Range 207.11.338.30 Forward Dividend & Yield N/A (N/A) NFLX 488.77 +1.50 +0.31% Volume 13.587,916 Ex-Dividend Date N/A Netflix, Inc. 10 AM 12 PM 02 PM 04 PM Trade prices are not sourced from all markets GOOG 2,513.93 -7.67 -0.30% Avg. Volume 18.861,833 1y Target Est 386.26 Alphabet Inc. Fair Value -2.82 -0.08% Related Research Analyst Report: Facebook, Inc. , Chart Events Bearish pattern detected AMZN 3,346.83 Amazon.com, Inc XX.XX Undervalued Performance Outlook Mid 27% Est. Return % hool, Momentum TSLA 609.89 -0.23 Analyst Report: Facebook, Inc. View more -0.04% Shorts Term 2W-W Long Term 9M- Term 6W - 9 View details View all chart patterns Tesla, Inc 127.35 +1.24 +0.98% AAPL Apple Inc All News Press Releases Research Reports Investor's Business Daily 4 hours ago Total ESG Risk score > These Are The 5 Best Stocks To Buy And Watch Now 24.8 Medium 38th percentile Buying a stock is easy, but buying the right stock without a time-tested strategy is incredibly hard. So what are the best stocks to buy now or put on a watchlist? Earnings > O Consensus EPS 4.00 Insider Monkey. 12 hours ago 380 3.60 Hedge Funds Have Never Been This Bullish On Facebook (FB) 3.40 320 In this article we are going to use hedge fund sentiment as a tool and determine whether Facebook Inc (NASDAQ:FB) is a good investment right now. We like to analyze hedge fund... 300 2.80 2.60 Hedge Funds Aren't Crazy About The Walt Disney Company (DIS) Anymore Insider Monkey Hedge Funds Are Dumping Apple Inc. (AAPL) Insider Monkey O 2.40 220 2.00 0 Finding Basic Corporate Financial Data Online, with Yahoo Finance To answer the following questions, go to the Yahoo Finance site and look up the financial information for Facebook using its "ticker symbol" FB. You will have to access the web version of Yahoo Finance, since the mobile app version only gives a partial version of the financial data required. Fire up a calculator for this assignment, because you'll need to perform some basic arithmetic such as calculating percentages. If you are uncertain about how to calculate percentages, invest three minutes here e. If you are uncertain about calculating ratios, invest another four minutes here e. Here are the two most common mistakes to avoid on this assignment: 1) On financial statements for most companies, the dollar values given are usually in thousands - if so, it will say this in the fine print at the top of the statement. This is the case with the dollar values in Facebook's financial statements, which are in thousands, so you need to add an extra three zeros. So, a number such as $1,000,000 (one million) in fact means $1,000,000,000 (one billion). Don't confuse millions and billions! 2) Make sure you are looking at the right time period that the question is asking about. If it asks for figures for 2020, don't look up the numbers for 2019 instead. And if it asks for the latest quarterly data, don't look at the annual data instead. Notice on the web page that you can select whether to look at income statement, balance sheet or cash flow, you can also toggle between annual and quarterly figures. IGNORE THE COLUMN LABELED "TTM" (TRAILING 12 MONTHS) -- JUST LOOK AT THE COLUMNS WITH a FISCAL YEAR DATE OR FISCAL QUARTER DATE AT THE TOP OF THE COLUMN

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts