Asset W has an expected return of 13 percent and a beta of 1.25. If the risk-free

Question:

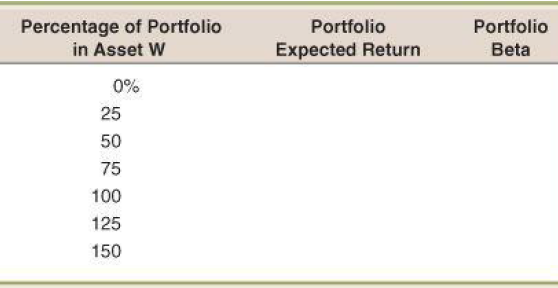

Asset W has an expected return of 13 percent and a beta of 1.25. If the risk-free rate is 4.5 percent, complete the following table for portfolios of Asset W and a risk-free asset. Illustrate the relationship between portfolio expected return and portfolio beta by plotting the expected returns against the betas. What is the slope of the line that results?

Transcribed Image Text:

Percentage of Portfolio in Asset W Portfolio Portfolio Expected Return Beta 0% 25 50 75 100 125 150

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 85% (20 reviews)

First we need to find the of the portfolio The of the riskfree asset is zero and the weight of the r...View the full answer

Answered By

Muhammad Umair

I have done job as Embedded System Engineer for just four months but after it i have decided to open my own lab and to work on projects that i can launch my own product in market. I work on different softwares like Proteus, Mikroc to program Embedded Systems. My basic work is on Embedded Systems. I have skills in Autocad, Proteus, C++, C programming and i love to share these skills to other to enhance my knowledge too.

3.50+

1+ Reviews

10+ Question Solved

Related Book For

Essentials Of Corporate Finance

ISBN: 9780073382463

7th Edition

Authors: Stephen Ross, Randolph Westerfield, Bradford Jordan

Question Posted:

Students also viewed these Business questions

-

You have $250,000 to invest in a stock portfolio. Your choices are Stock H, with an expected return of 14 percent, and Stock L, with an expected return of 10.1 percent. If your goal is to create a...

-

Blue Stripes Co. is comparing two different capital structures. Plan I would result in 8,500 shares of stock and $313,500 in debt. Plan II would result in 12,000 shares of stock and $198,000 in debt....

-

In the chapter opening, we discussed the cash positions of several companies. Automobile manufacturers also have enormous cash reserves. At the beginning of 2009, Ford Motor Co. had $28.2 billion in...

-

Suppose Nordic Boots was making production decisions for the following six boots: ot Price E(Demand) Std. Dev (Demand) Co Cu Exp. Profit Max. Profit A 220 1000 400 35.2 52.8 1101 39201 52800 230 2000...

-

(a) Prove that if A is symmetric and tridiagonal, then all matrices Ak appearing in the Q R algorithm are also symmetric and tridiagonal. First prove symmetry. (b) Is the result true if A is not...

-

What is the distinction between the number of customers in the queue and the number in the system?

-

How might a hacker access and manipulate a digital device for illegal purposes? Are the Internet of Things (IoT) devices at risk for hacker access and manipulation?

-

Your best friend just received a gift of $7,000 from his favorite aunt. He wants to save the money to use as starter money after college. He can invest it (1) risk-free at 6%, (2) taking on moderate...

-

1. A thin film is laid over a glass pane as shown. White light is incident on the film, coming straight in. At a point where the light is incident on the film, it appears green ( = 525 nm). Find (a)...

-

Refer to Apple's financial statements in Appendix A to answer the following. 1. How many shares of common stock are issued and outstanding at September 26, 2015, and September 27, 2014? How do these...

-

A stock has a beta of 1.2 and an expected return of 11.8 percent. A risk-free asset currently earns 3.8 percent. a. What is the expected return on a portfolio that is equally invested in the two...

-

Stock Y has a beta of 1.30 and an expected return of 13 percent. Stock Z has a beta of .75 and an expected return of 10.5 percent. If the risk free rate is 4.5 percent and the market risk premium is...

-

How can you establish guidelines for choosing hazard operations actions?

-

Explain Coca-Cola's distribution network based on the designs. If there is no information or you think the current network is not working well, suggest a new design, and explain why you think it is a...

-

Explain each of the below values that must be created by every successful organization and how OPSCM is involved in each. Which is the most important? Customer Value People Value Economic Value...

-

Explain the ethical failure of Equifax decision, apart from violation of law. Present an analysis and explanation of an ethical course of conduct and reasoning that the company leadership could have...

-

Explain under what circumstance firms should go for a centralized purchasing approach or decentralized purchasing approach and why. The extent to which you explain circumstance/conditions for a...

-

2. Four forms of Planning- Based on your SWOT analysis, complete the table below by writing plans for each of the four forms. Assume you are part of the management board for the College. 1 tttt a) 1...

-

During the first month of operations, these events and transactions occurred for Astromech Accounting Services Inc.: May 1 Common shares were issued for $20,000 cash and a $10,000 note receivable. 1...

-

Based on the scenario described below, generate all possible association rules with values for confidence, support (for dependent), and lift. Submit your solutions in a Word document (name it...

-

An insurance company is offering a new policy to its customers. Typically, the policy is bought by a parent or grandparent for a child at the childs birth. The details of the policy are as follows:...

-

You have just arranged for a $1,800,000 mortgage to finance the purchase of a large tract of land. The mortgage has a 7.8 percent APR, and it calls for monthly payments over the next 30 years....

-

What is the value of an investment that pays $25,000 every other year forever, if the first payment occurs one year from today and the discount rate is 9 percent compounded daily? What is the value...

-

If you could model yourself after one or more of the historical leaders we discussed in this chapter, whom would you model yourself after? Please learn more about the leader you chose. Identify two...

-

You are a market researcher. You've been asked to compare the way 2 news sources present the same issue for possible consideration by your market research department and public relations staff....

-

Explain about the application software available for Unix operating system?

Study smarter with the SolutionInn App