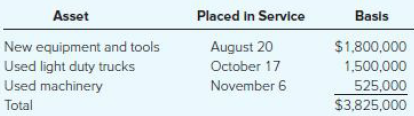

Acorn Construction (calendar-year-end C corporation) has had rapid expansion during the last half of the current year

Question:

The used assets had been contributed to the business by its owner in a nontaxable transaction.

a. What is Acorn€™s maximum cost recovery deduction in the current year?

b. What planning strategies would you advise Acorn to consider?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Essentials Of Federal Taxation 2019

ISBN: 9781260190045

10th Edition

Authors: Brian Spilker, Benjamin Ayers, John Robinson, Edmund Outslay, Ronald Worsham, John Barrick, Connie Weaver

Question Posted: