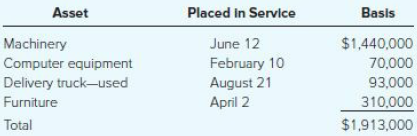

Assume that Sivart Corporation has 2018 taxable income of $1,750,000 for purposes of computing the §179 expense

Question:

a. What is the maximum amount of §179 expense Sivart may deduct for 2018?

b. What is the maximum total depreciation (§179, bonus, MACRS) that Sivart may deduct in 2018 on the assets it placed in service in 2018?

CorporationA Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Essentials Of Federal Taxation 2019

ISBN: 9781260190045

10th Edition

Authors: Brian Spilker, Benjamin Ayers, John Robinson, Edmund Outslay, Ronald Worsham, John Barrick, Connie Weaver

Question Posted: