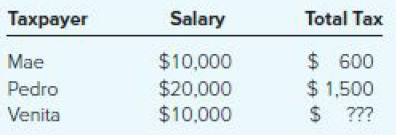

Given the following tax structure, what tax would need to be assessed on Venita to make the

Question:

Transcribed Image Text:

Total Tax Тахраyer Salary $ 600 $10,000 $20,000 $10,000 Mae Pedro $ 1,500 Venita

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 60% (5 reviews)

Horizontal equity means that two ...View the full answer

Answered By

Utsab mitra

I have the expertise to deliver these subjects to college and higher-level students. The services would involve only solving assignments, homework help, and others.

I have experience in delivering these subjects for the last 6 years on a freelancing basis in different companies around the globe. I am CMA certified and CGMA UK. I have professional experience of 18 years in the industry involved in the manufacturing company and IT implementation experience of over 12 years.

I have delivered this help to students effortlessly, which is essential to give the students a good grade in their studies.

3.50+

2+ Reviews

10+ Question Solved

Related Book For

Essentials Of Federal Taxation 2019

ISBN: 9781260190045

10th Edition

Authors: Brian Spilker, Benjamin Ayers, John Robinson, Edmund Outslay, Ronald Worsham, John Barrick, Connie Weaver

Question Posted:

Students also viewed these Business questions

-

Given the following tax structure, what minimum tax would need to be assessed on Shameika to make the tax progressive with respect to average tax rates? Taxpayer____ Salary ______Muni-Bond Interest...

-

Using the facts in the previous problem, what minimum tax would need to be assessed on Shameika to make the tax progressive with respect to effective tax rates? In previous problem, Taxpayer____...

-

OGrady Apparel Company was founded nearly 160 years ago when an Irish merchant named Garrett OGrady landed in Los Angeles with an inventory of heavy canvas, which he hoped to sell for tents and wagon...

-

rewrite/downside Integrity and credibility are the ethics of professional practice that Juan Gomez was lacking in this instance. Juan Gomez lacked integrity because he created a conflict of interest...

-

In what ways can knowledge or lack thereof, of diversity affect your role as a special education educator? Specifically address diversity as a part of families, cultures, and school.

-

Name a strategy that you could do to try to keep young females engaged in physical activity as they enter adulthood. How can you contribute to community programming to serve as a role model for the...

-

Construct a bar graph for each of the following (assume the independent variable is group and the dependent variable is time): a. Group \(\mathrm{A}(N=5, M=4.00, s=1.58)\); Group B \((N=5, M=6.00,...

-

Nonprofit organizations routinely rely on generous corporate donations, and it is common to name facilities after benefactors. The Nationwide Childrens Hospital in Ohio is no exception; its name...

-

Soarch Fila Home Insert Draw Design Transitions Animations Slide Show Record Review View Help Layout R New AAA E-E-3 JUS+AV Ax LA OOO\\ ALLOCG Record Share Shape F- Ind Stace Ouding Aange Cuck...

-

The data show the number of points the winning team scored in the Rose Bowl. Find the mean and modal class for the data. Class Frequency 1420 10 2127 11 2834 6 3541 8 4248 4 4955 1

-

Using the facts in problem 40, if Scot and Vidia earn an additional $80,000 of taxable income, what is their marginal tax rate on this income? How would your answer differ if they, instead, had...

-

Benita is concerned that she will not be able to complete her tax return by April 15. Can she request an extension to file her return? By what date must she do so? Assuming she requests an extension,...

-

What are the purpose and benefits of creating a comprehensive crisis response plan before a crisis happens?

-

What mechanisms can organizations implement to ensure ethical behavior and social responsibility among their employees? Explain

-

How do theories of motivation apply to the design of incentive systems in a sales-driven corporate environment? Explain

-

In what ways can organizational development interventions foster a culture of continuous learning and adaptability?

-

How does the concept of organizational fit influence recruitment and selection processes, and what are the potential consequences of poor fit?

-

What is true of the relationship between financial analyses and HR decisions?

-

Hikers and other outdoor enthusiasts have a new concern, the Zika virus. Physicians are recommending that people use a mosquito repellant while in areas where mosquitoes are present. A statistician...

-

The figure shows a bolted lap joint that uses SAE grade 8 bolts. The members are made of cold-drawn AISI 1040 steel. Find the safe tensile shear load F that can be applied to this connection if the...

-

Dontae stated that he didn't want to earn any more money because it would "put him in a higher tax bracket." What is wrong with Dontae's reasoning?

-

Describe the three different tax rates discussed in the chapter and how taxpayers might use them.

-

Describe the three different tax rates discussed in the chapter and how taxpayers might use them.

-

1. How does marketing create value, and how do firms become more value driven? 2. Describe a firm's stakeholders and how they are impacted by conscious marketing.

-

Beginning inventory 100 units @ $8.00 = $ 800 Purchase # 1 200 units @ $6.00 = 1,200 Purchase # 2 100 units @ $12.00 = 1,200 Total 400 units $3,200 Ending inventory is 150 units. 1. What is cost of...

-

Sam's Ice Creams, a cottage country favourite in Northern Ontario, has launched a new range of ice creams branded as "Summer Flavours." To capitalize on the cottage and tourism season from May to...

Study smarter with the SolutionInn App