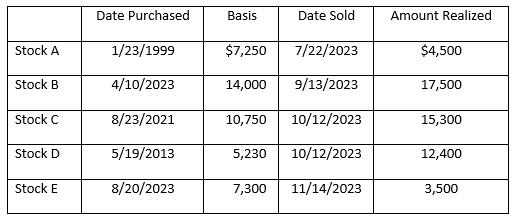

Grayson (single) is in the 24 percent tax rate bracket and has the sold the following stocks

Question:

Grayson (single) is in the 24 percent tax rate bracket and has the sold the following stocks in 2023:

- What is Grayson’s net short-term capital gain or loss from these transactions?

- What is Grayson’s net long-term gain or loss from these transactions?

- What is Grayson’s overall net gain or loss from these transactions?

- What amount of the gain, if any, is subject to the preferential rate for certain capital gains?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

McGraw Hills Essentials Of Federal Taxation 2024

ISBN: 9781265364656

15th Edition

Authors: Brian Spilker, Benjamin Ayers, John Robinson, Edmund Outslay, Ronald Worsham, John Barrick, Connie Weaver

Question Posted: