AMP Corporation (calendar-year-end) has 2023 taxable income of $1,900,000 for purposes of computing the 179 expense. During

Question:

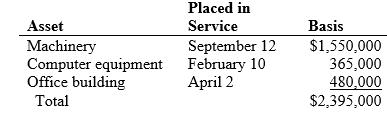

AMP Corporation (calendar-year-end) has 2023 taxable income of $1,900,000 for purposes of computing the §179 expense. During 2023, AMP acquired the following assets:

- What is the maximum amount of §179 expense AMP may deduct for 2023?

- What is the maximum total depreciation, including §179 expense, that AMP may deduct in 2023 on the assets it placed in service in 2023, assuming no bonus depreciation?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

McGraw Hills Essentials Of Federal Taxation 2024

ISBN: 9781265364656

15th Edition

Authors: Brian Spilker, Benjamin Ayers, John Robinson, Edmund Outslay, Ronald Worsham, John Barrick, Connie Weaver

Question Posted: